We're now in the second half of August, and while the weather remains warm (quite hot here in Denver!), for many of us, summer officially ends when the kids return to school. This annual ritual for many Americans involves dropping children off for their first day of class. For us, it's always heartwarming to witness the kids coming together again, radiating that nervous yet excited energy that accompanies new beginnings. We see an abundance of potential in these young minds, envisioning future doctors, lawyers, tradespeople and perhaps even a few investment analysts.

We used to apply a similar perspective to Small Capitalization stocks, viewing them as future Amazons, Googles, Medtronics or Walmarts in the making, intermingled with potential acquisition targets and businesses capable of generating organic growth that would propel them up the market cap scale, eventually becoming Mid Cap stocks. However, in an investment landscape dominated by venture capital, private equity and deep private markets, it has become increasingly evident that the nature of Small Capitalization indexes has shifted. Gone are the days when smaller companies depended on the growth capital provided by public markets, leaving Small Capitalization indices a mere semblance of what they once signified to investors.

Signs of Change

Our team conducted an analysis of how Small Capitalization stocks have transformed and identified three key indicators that have captured our attention:

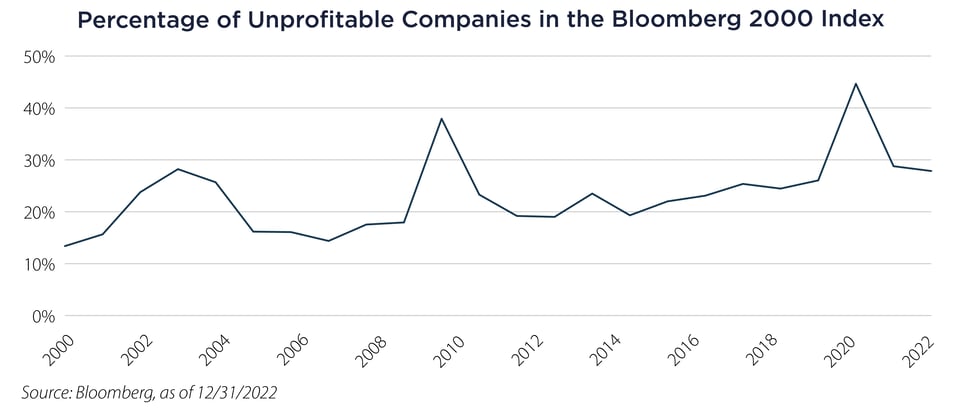

1. An increasing number of unprofitable companies in the Bloomberg 2000 Index, suggesting that the index comprises fewer quality companies and, consequently, the pool of high-quality options in the Small Cap universe has dwindled.

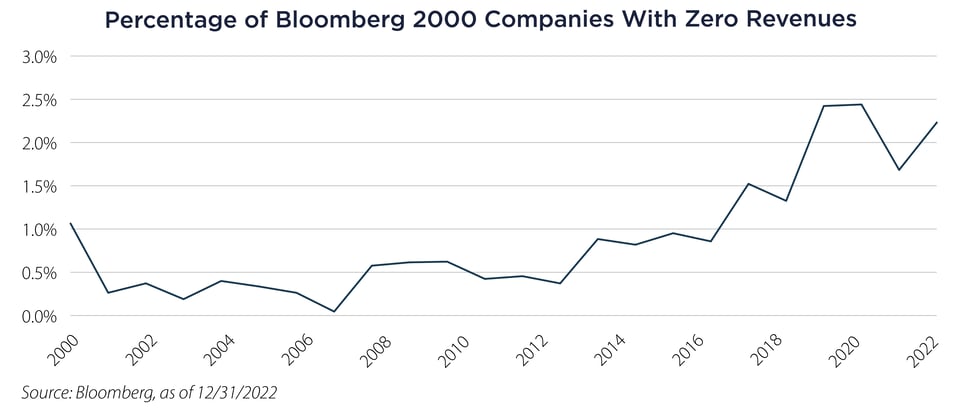

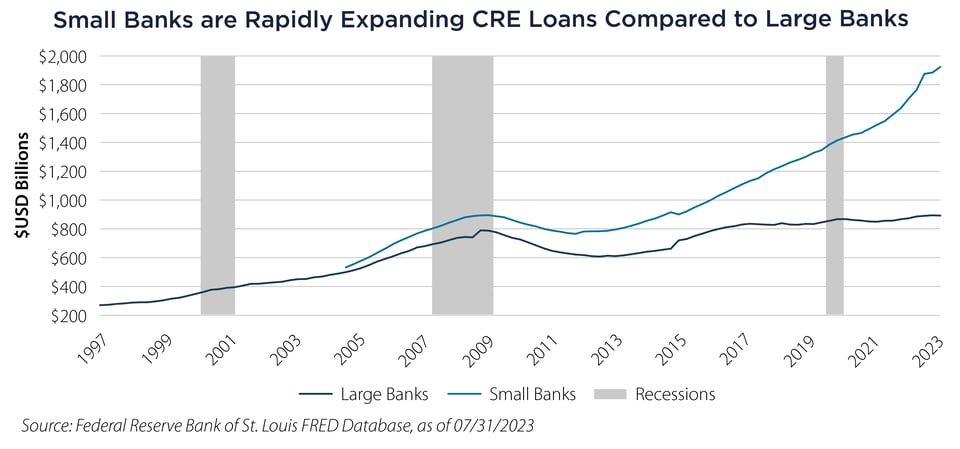

2. A higher percentage of pre-revenue companies in the Bloomberg 2000 Index. This implies that the index provider has had to include less established equities with shorter track records to populate index positions. 3. The Industry composition of Small Capitalization indices has shifted away from traditional growth industries to encompass whatever remains within the small-cap universe. This includes a significant portion of Small Cap Banks, where our growing concern revolves around their core business model. These smaller banks are facing heightened competition for higher margin banking relationships from direct lending funds and financial technology companies. This competition has forced smaller banks to extend loans into risky areas such as Commercial Real Estate (CRE).

3. The Industry composition of Small Capitalization indices has shifted away from traditional growth industries to encompass whatever remains within the small-cap universe. This includes a significant portion of Small Cap Banks, where our growing concern revolves around their core business model. These smaller banks are facing heightened competition for higher margin banking relationships from direct lending funds and financial technology companies. This competition has forced smaller banks to extend loans into risky areas such as Commercial Real Estate (CRE).

Implications for Small Cap Investors

Our foremost worry for investors in Small Cap stocks centers around their exposure to low-quality companies that lack growth potential, aren't attractive as acquisition targets and frequently fail to yield sufficiently high returns to warrant investment. In short, the current Small Capitalization stocks are grappling with an adverse selection issue. Promising companies often delay their initial public offerings until they are much further along in their development, opt to remain private, or worse, go public only after private equity has extracted profits and loaded the company with debt.

Our secondary concern pertains to index construction and the resultant investor exposures. As the number of Small Capitalization issues has dwindled over the years, index composition has shifted to include whatever is left, leading to an increase of Small Capitalization Banks (approximately 9% of the Bloomberg 2000) and pre-product Biotech Companies (also around 9% of the Bloomberg 2000). At roughly 18% of the passive benchmark, these two industry groups alone pose an undesirable level of risk, coupled with a lamentably low potential for return.

Our Approach to Investing in Small Cap Stocks Today

As an investment team, our approach to investing in Smaller Capitalization companies and Small Capitalization indices is characterized by caution. We seek out funds that filter out low-quality and unseasoned companies within the Small Cap universe, thus cultivating targeted exposure to the high-quality segment of the Small Cap universe that still embodies growth and opportunity. Moreover, we dedicate time to exploring Mid Cap stocks that exhibit some of the same commendable attributes that Small Cap stocks once showcased.

Fortunately, our evolving perspective on the potential of Small Cap stocks has not influenced optimism regarding the potential for our children. Unlike Small Caps, today's kids are commencing their journey from a point reminiscent of kids throughout history, albeit enriched by the phenomenal technology that facilitates their growth. Perhaps one day, we will once again regard Small Cap stocks through the same lens with which we view our children – brimming with optimism about their future accomplishments.

Important Disclosures & Definitions

Bloomberg 2000 Index: measures the performance of the small-cap segment of the US equity universe. One may not invest directly in an index.

AAI000399 08/22/2024