Another exciting, high-scoring college football season has kicked off with many of the usual suspects in the Top 25, and also a few new exciting teams like our very own Colorado Buffaloes! However, while the high powered offenses get much of the media attention, have you noticed that by the end of the season, the teams with superior defenses are the teams that typically win the championship?

Just like the uncertain outcome of the regular college football season, the economic and Federal policy cycle end game is unclear. However, most would agree we are in the latter stages of this cycle, with the Federal Reserve (Fed) squarely in the restrictive camp, and we might even be in the 4th quarter. If so, this is exactly the time you want to think about putting in your first-string defense. In this case, we feel municipal bond allocations may be the preferred choice over cash as after-tax yields are now favorable for many investors, with the opportunity for upside (unlike in cash) as the end game cycle unfolds.

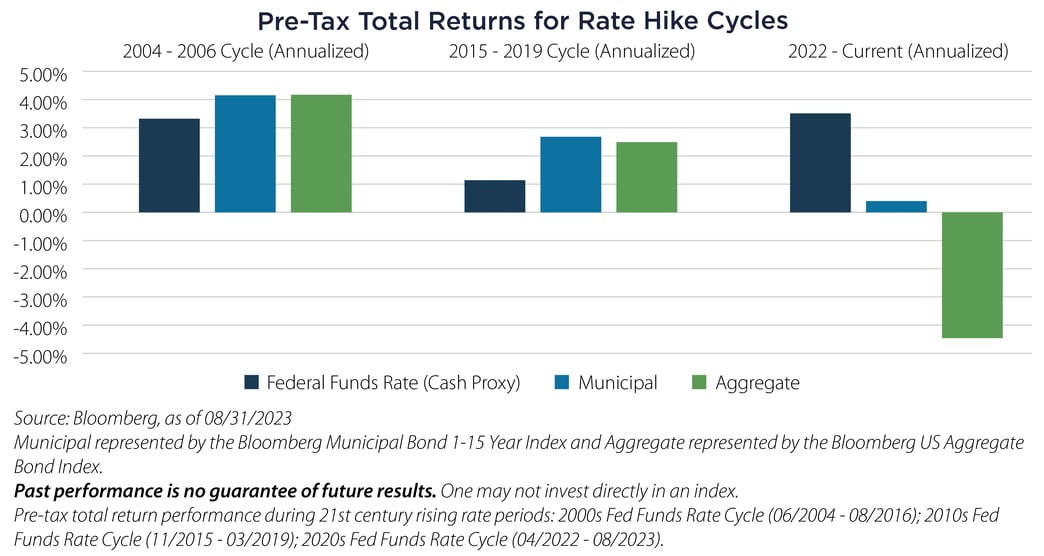

During end game tightening cycles, investors typically begin to move out of the curve (extending duration) for better total return possibilities. In some cases investors become more concerned about credit in a slowdown scenario and upgrade to higher quality investments. Finally, as the yield curve normalizes, investors may be able to enjoy potentially higher income with less downside risk as the Fed slows or stops its hikes. Municipal bonds check these boxes for many investors in taxable (non-qualified) accounts. Consider the behavior and results in the last tightening cycles since 2000 as shown below. Keep in mind these are pre-tax returns and the current cycle is not over.

It’s Time to Recruit Talented & Disciplined Defensive Players Now

It’s Time to Recruit Talented & Disciplined Defensive Players Now

It is easy to forget that rising short term rates often set the stage for positive fixed income returns throughout the full hiking cycle. If we are nearing an end to the Fed hike cycle this period, then it makes sense to start scaling out into longer duration, conservative investments now. While the game could go into overtime with higher for longer, the yield buffer that exists today offers protection. We suggest calling a time-out and getting your first-team defense out there before the other team does—the municipal bond defensive line.

Municipal bonds aren’t flashy, but they typically provide a very strong defense that can keep you in the game while earning very attractive taxable equivalent income. This year’s income generation is much higher than it has been in years and may result in some surprise tax liabilities for taxable investors. Municipal bonds allow you to keep more of your income and reinvest it, effectively compounding tax-exempt income over time, which is a long-term key to building wealth.

We prefer proven, disciplined and active municipal bond strategies, managed by experienced management teams that do the research on individual credits and uncover end-game opportunities in this relatively opaque sector.

Important Disclosures & Definitions

Bloomberg Municipal Bond 1-15 Year Index: an unmanaged index comprised of fixed-rate, investment-grade tax-exempt bonds with remaining maturities between 1 and 15 years.

Bloomberg US Aggregate Bond Index: a broad-based benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, fixed-rate agency MBS, ABS and CMBS (agency and non-agency).

Federal Funds Rate: the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which the Fed suggests commercial banks borrow and lend their excess reserves to each other overnight.

One may not invest directly in an index.

AAI000410 09/19/2024