• Copper’s unique properties make it a key component of the energy transition that is extremely unlikely to be unseated.

• New energy technologies are more copper-intensive than traditional technologies, but producers have been slow to expand production in the face of growth concerns and high interest rates.

• Decreased price sensitivity caused by government funding and social pressure means copper prices may climb to new highs to incentivize the requisite increase in supply.

Why Copper?

We’ve repeatedly argued that traditional energy producers will likely be beneficiaries for years or decades to come. In similar fashion, the raw materials on which the energy transition depends have seen deficits in capital expenditures (CapEx) that set them up for massive supply shortages in the face of a global shift toward newer, more efficient technology. Sitting at the base of the mountain of minerals required to re-electrify the developed world is copper.

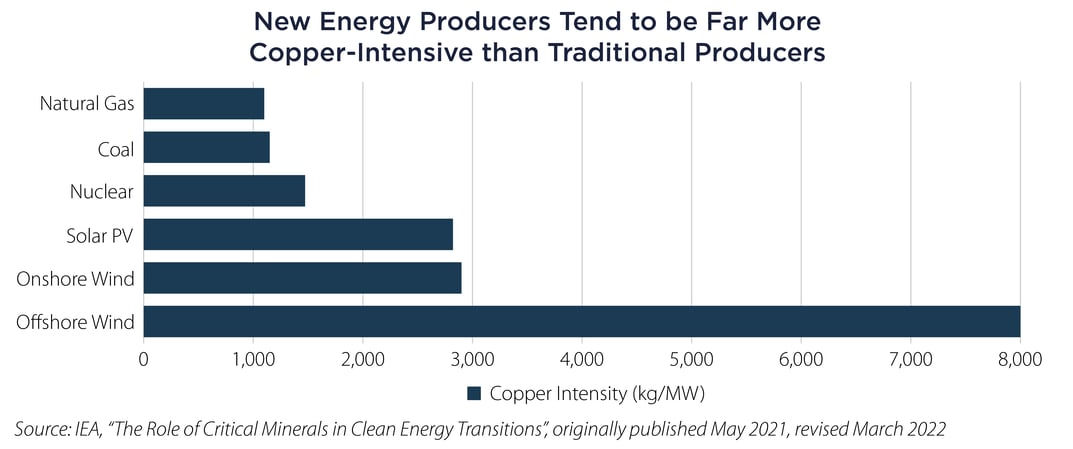

Copper’s unique abilities to conduct heat and electricity and to resist corrosion make it the single most important metal in the energy transition, and it already commanded a prominent role in just about every aspect of our lives. New advanced technologies tend to be more copper-intensive, and the concerted push by the world’s biggest economies to adopt these new technologies implies a never-before-seen surge in demand.

The Problem

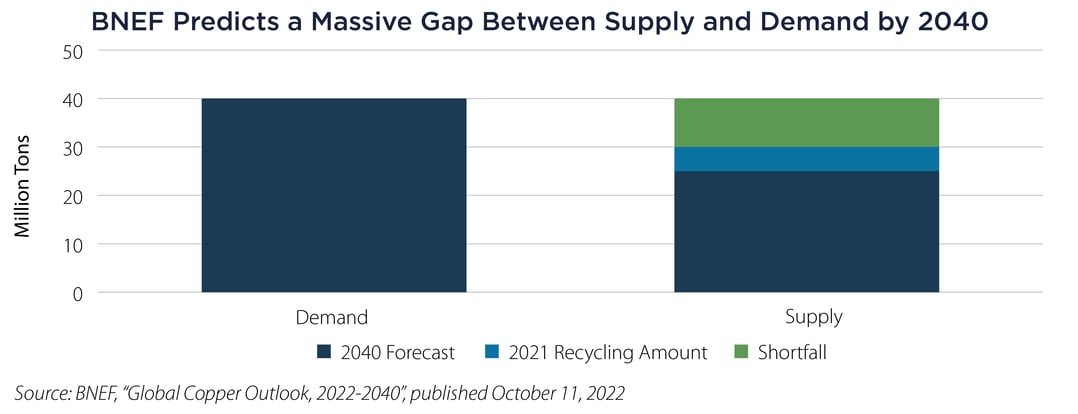

In an October 2022 report, Bloomberg New Energy Finance (BNEF) released a report on the global copper outlook with the subtitle “the coming age of scarcity.” As one might guess, they highlight the massive disparity between forecast primary supply (which is from mining as opposed to recycling) and forecast demand—25 million tons and 40 million tons respectively, a shortage of 15 million tons. While recycled copper accounted for almost 5 million tons in 2021, copper’s resistance to corrosion means it also has a long working life. Paired with the increase in copper intensiveness, this implies there isn’t likely to be an increase in retired copper for recycling as new products are created.

The Solution

The Solution

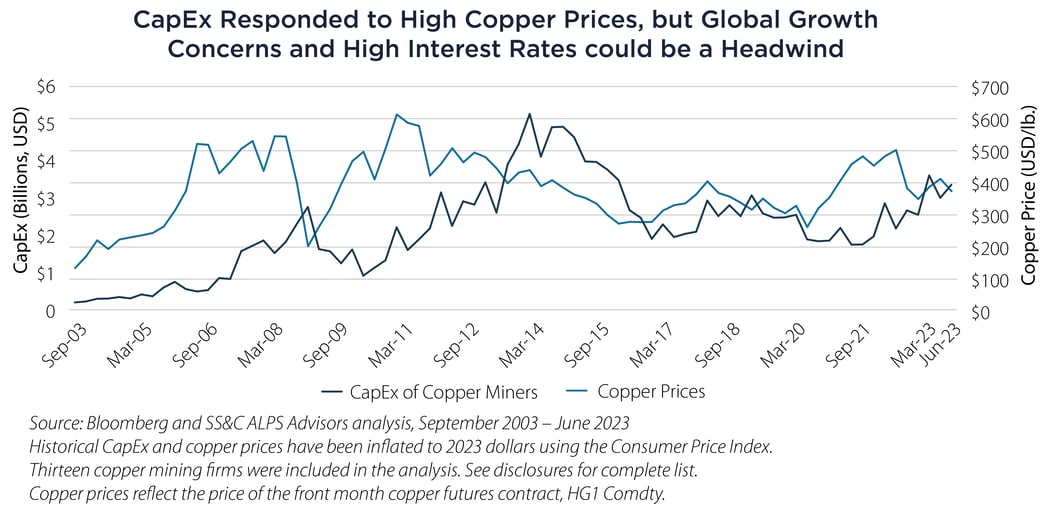

While copper producers did respond to the high copper prices in 2020-2022 with marginal increases in CapEx, economic uncertainty and high interest rates are headwinds to continued investment, especially as copper prices have come down from their highs in 2022.

We’ve all heard the old adage “the cure for high prices is high prices,” which points to demand falling as prices rise. The unique dynamic in the energy transition is that government funding and social pressure decrease the elasticity of demand for key minerals such as copper. On the other side of the equation, as suppliers’ margins are squeezed by higher rates, they will require sustained higher prices to rationalize new exploration and production. We expect they will get what they need, and we will climb the copper mountain like we did in the first decade of the 2000s.

Important Disclosures & Definitions

Companies used for CapEx analysis: FREEPORT-MCMORAN INC, FIRST QUANTUM MINERALS LTD, SOUTHERN COPPER CORP, LUNDIN MINING CORP, KGHM POLSKA MIEDZ SA, AURUBIS AG, JIANGXI COPPER CO LTD-H, CAPSTONE COPPER CORP, ERO COPPER CORP, TASEKO MINES LTD, ATALAYA MINING PLC, TONGLING NONFERROUS METALS-A, JIANGXI COPPER CO LTD-A.

Consumer Price Index (CPI): a measure of the average change over time in the prices paid by urban consumers for a representative basket of consumer goods and services. One may not invest directly in an index.

AAI000455 10/31/2024