• Natural gas exploded nearly 32% in Q1 as a frigid winter met a year of underproduction.1

• Additional export capacity added upside pressure, and capacity is set to grow by almost 20% in 2025.2

• Oil held steady into March, then took two hits in early April when tariffs and OPEC production increases knocked Brent crude down about $10.3

• Between shaky demand and political risk, big gains look unlikely, but further losses may also be capped.

The first quarter of 2025 was an excellent quarter for natural gas vendors, as a colder-than-expected winter collided with a year’s worth of underproduction and returned 47.5% to the front-month contract from late January into early March.4 Natural gas averaged $2.51 in 2024 vs. a pre-COVID-19 long-term average of $3.43.5 This led to producers pulling back as they waited for a price recovery, which they got in Q1 when natural gas held an average price of $3.87.6,7

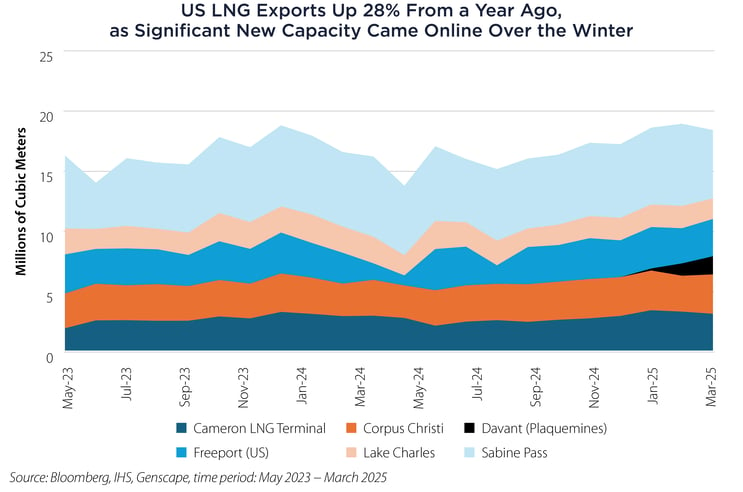

Adding further upward pressure, a new Liquefied Natural Gas (LNG) terminal in Louisiana opened in December 2024 and rapidly ramped up operation, accounting for 11% of US exports just four months later.8,9

Looking ahead, LNG export capacity is set to swell by nearly 20% in 2025 as multiple terminals come online or expand.2 The additional demand from foreign markets for US natural gas will continue to apply upward pressure on US natural gas.

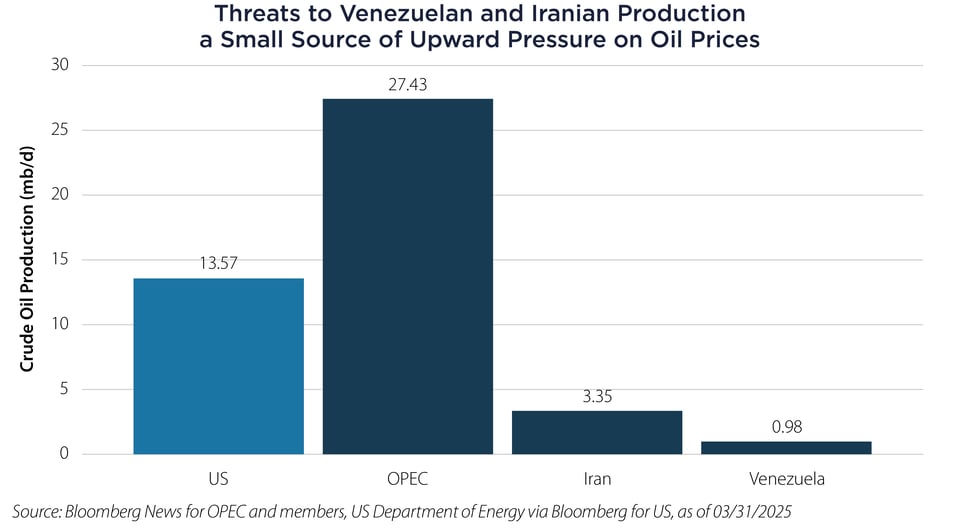

Oil’s outlook is somewhat less optimistic, and growth concerns have been a feature of oil market outlooks for some time.10 OPEC has finally begun rolling off its production cuts, with the first increase taking effect in April. This was mostly eaten up by countries who had already been overproducing. The second increase, however, was announced on April 3rd at 3x the amount the market expected.11 If OPEC proceeds with its accelerated production plan, there will likely be additional downward pressure on already-depressed oil prices.

On the other side of the equation, sanctions on Venezuela and Iran could remove barrels from an oversupplied market, potentially providing relief to US producers or allowing OPEC’s other members to proceed with their planned production increases. Venezuela’s exports fell about 12% month-on-month in March after permit revocations and a 25% import tariff, while Iran—responsible for roughly 12% of OPEC output—is under fresh pressure from US action against its “shadow fleet.”12,13,14 Neither alone is likely to spark a rally, but together they may be enough to prevent further slide.

Of course, the big event in energy markets, as in most markets, was the announcement of the Liberation Day tariffs on April 2nd. Brent crude fell over $10 on the combined news of tariffs and OPEC’s surprise production increases, and natural gas is back below $3 after breaking $4 in March.15 Near-term, total resolution of the global trade war would be massively stimulative to energy markets, just as further escalation from the current level would be massively detrimental.

The likely outcome is somewhere in between, but the possibility of a hangover in energy markets makes us think the upside is rather muted in the near-term. On the other hand, given oil prices are near recent lows and the US is ramping up LNG export capacity, we see limited downside as well. The result may be a sideways trending energy market until growth picks back up or an exogenous event causes a major disruption.

Important Disclosures & Definitions

1 Source: Bloomberg. Time period: 12/31/2024 – 03/31/2025. The reference asset for natural gas returns is the front-month natural gas contract listed on the NYMEX exchange (NG1 Comdty).

2 Zaretskaya, V., & Ricker, C. (April 3, 2025). How Will the Start-up Timing of the New US LNG Export Facilities Affect Our Forecast? US Energy Information Administration (EIA).

3 Source: Bloomberg. Proxy for Brent crude oil price is the front-month contract on the ICE Europe exchange (CO1 Comdty). The contract price on 04/02/2025 (prior to the tariff announcement) was $74.95, and the contract price on 04/14/2025 was $64.88.

4 Source: Bloomberg. Time period: 01/31/2025 – 03/10/2025. The reference asset for natural gas price is the front-month natural gas contract listed on the NYMEX exchange (NG1 Comdty).

5 Source: Bloomberg. Pre-COVID-19 time period: 04/01/2009 – 03/31/2019. Prices were unnaturally subdued during the COVID-19 pandemic and unnaturally elevated during the first couple years of the Russo-Ukrainian war. For this reason, a long-term average was taken prior to both events. The reference asset for natural gas price is the front-month natural gas contract listed on the NYMEX exchange (NG1 Comdty).

6 EIA. March 2025. Short-Term Energy Outlook (STEO) March 2025. US Energy Information Administration (EIA).

7 Source for Q1 average: Bloomberg. Time period: 01/01/2025 – 03/31/2025. The reference asset for natural gas price is the front-month natural gas contract listed on the NYMEX exchange (NG1 Comdty).

8 Zaretskaya, V. (January 13, 2025). The Eighth US Liquefied Natural Gas Export Terminal, Plaquemines LNG, Ships First Cargo. US Energy Information Administration (EIA).

9 Source: Bloomberg. Time period: December 2024 – March 2025. Terminal began operations in December 2024, and in March 2025 exported 2.3 million cubic meters out of total US exports of 21 million cubic meters.

10 The December 2024 International Energy Agency (IEA) Oil Market Report (OMR) referenced a “subdued pace of global oil demand growth.” The January 2025 OMR referenced a marginal improvement, then the February OMR stated that “sentiment shifted to concerns over the world economy.”

11 Astakhova, O., Ghaddar, A., & Lawler, A. (April 3, 2025). OPEC+ Unexpectedly Speeds Up Oil Output Hikes, Oil Drops. Reuters.

12 Parraga, M. (April 2, 2025). Venezuela’s Oil Exports Fall 11.5% over US Tariffs and Sanctions, Shipping Data Show. Reuters.

13 Export totals source: Bloomberg News. Data as of 03/31/2025.

14 US Department of the Treasury. (February 24, 2025). Treasury Imposes Additional Sanctions on Iran’s Shadow Fleet as Part of Maximum Pressure Campaign [press release]. US Department of the Treasury.

15 Source: Bloomberg. Proxy for Brent crude oil price is the front-month contract on the ICE Europe exchange (CO1 Comdty). The contract price on 04/02/2025 (prior to the tariff announcement) was $74.95, and the contract price on 04/14/2025 was $64.88.

AAI000934 04/29/2026