- Recent inflation challenges the conventional wisdom of leverage, with highly leveraged firms delivering superior relative returns.

- The current economic environment, featuring slowing inflation and nominal growth, alongside increasing interest rates, poses challenges for highly leveraged firms.

- Firms with higher indebtedness and lower credit quality risk insolvency due to significant disparities between current and future refinancing rates.

“How did you go bankrupt?” Bill asked.

“Two ways,” Mike said. “Gradually, then suddenly.”

- Ernest Hemingway, The Sun Also Rises

Those acquainted with the lessons of history's most accomplished investors understand the dangers of excessive leverage. The underlying principle is that leverage can amplify returns during favorable periods, yet it can lead to financial ruin during downturns. However, as many homeowners recently discovered, inflation upends the conventional wisdom found in these teachings. Echoing the sentiments of David Wooderson from Dazed and Confused (1993) - our wages go up, our home values go up but our debt stays the same value.

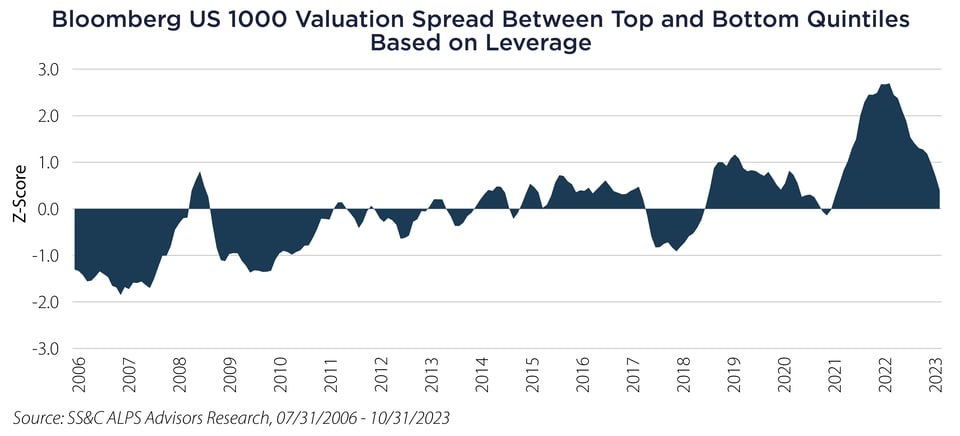

Consequently, it is not entirely surprising that highly leveraged investments have delivered relatively superior returns in recent years. This trend is evident in the outperformance of the high-yield and private credit markets, as well as in the equity markets, where the relative returns of the most indebted companies bettered those of the least indebted companies during this last inflationary episode. Unfortunately, all good things must eventually conclude, and now is likely a reasonable time to heed the wisdom of our investment predecessors.

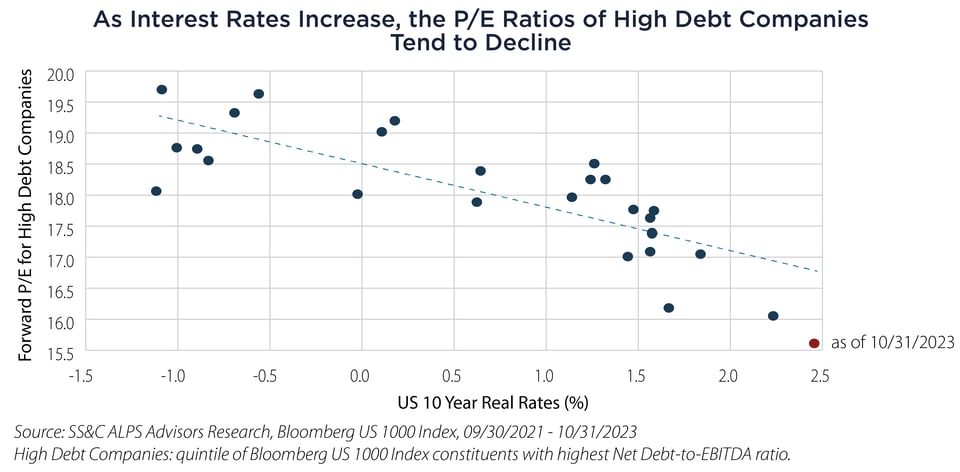

While interest rates have risen, the world we inhabit today is characterized by decelerating inflation and nominal growth, a situation that poses challenges for highly leveraged firms. The nearby chart illustrates the sensitivity of price/earnings (P/E) ratios of the most highly leveraged stocks in the Bloomberg US 1000 Index vs. changes in real interest rates since September of 2021. Thus far, these companies have seen a P/E decrease of almost 5% for every 1% rise in the real interest rate. Bear in mind that as inflation decreases with unchanged interest rates, there is a necessity for real interest rates to rise.

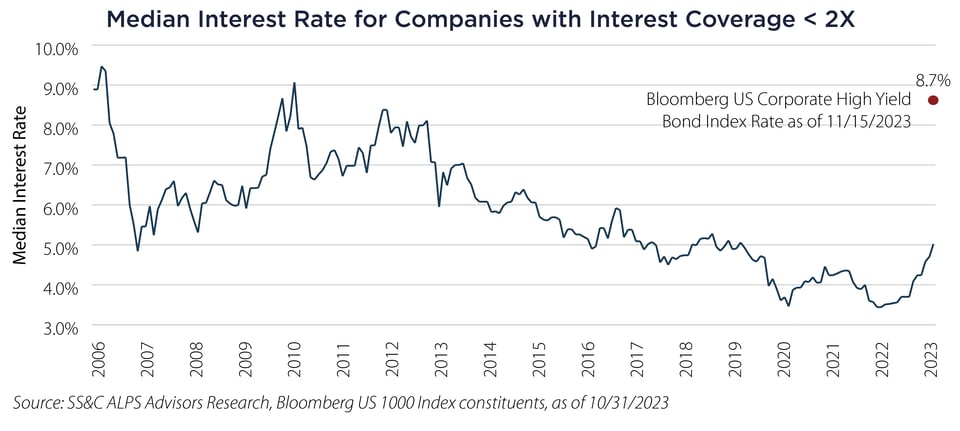

The fundamental issue arises from the fact that increased levels of indebtedness result in diminished credit quality. Therefore, leveraged companies qualify for loans with shorter maturities, often featuring floating interest rates, and must undergo refinancing sooner compared to firms with superior credit quality. As indicated below, the significant gap between the current interest rates these firms are paying and the rates at which they must refinance in the near future could potentially push many into more severe financial distress or insolvency. We are currently in the gradual phase of this cycle, be wary of suddenly.

Important Disclosures & Definitions

Bloomberg US 1000 Index: a float market-cap-weighted benchmark of the 1000 most highly capitalized US companies.

Bloomberg US Corporate High Yield Bond Index: measures the USD-denominated, high yield, fixed-rate corporate bond market.

Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA): a measure of a company’s overall financial performance.

Interest Coverage Ratio: a debt and profitability ratio used to determine how easily a company can pay interest on its outstanding debt. The interest coverage ratio is calculated by dividing a company's earnings before interest and taxes (EBIT) by its interest expense during a given period.

Net Debt-to-EBITDA Ratio: a debt ratio that shows how many years it would take for a company to pay back its debt if net debt and EBITDA are held constant.

Price/Earnings (P/E) Ratio: a valuation ratio of a company's current share price compared to its per-share earnings.

Z-Score: a numerical measurement that describes a value's relationship to the mean of a group of values, measured as standard deviations from the mean. If a Z-score is 0, it indicates that the data point's score is identical to the mean score. A Z-score of 1.0 would indicate a value that is one standard deviation from the mean.

One may not invest directly in an index.

AAI000518 11/21/2024