• Even as the original fleet of US nuclear reactors approaches end-of-life and is gradually taken offline, the environment for new nuclear energy capacity continues to improve.

• Three primary variables with outsized influence on the future of nuclear energy are popularity, funding and technology. All three of these are increasingly favorable.

• From an investor’s perspective, new interest in nuclear energy could provide new opportunities.

Popularity

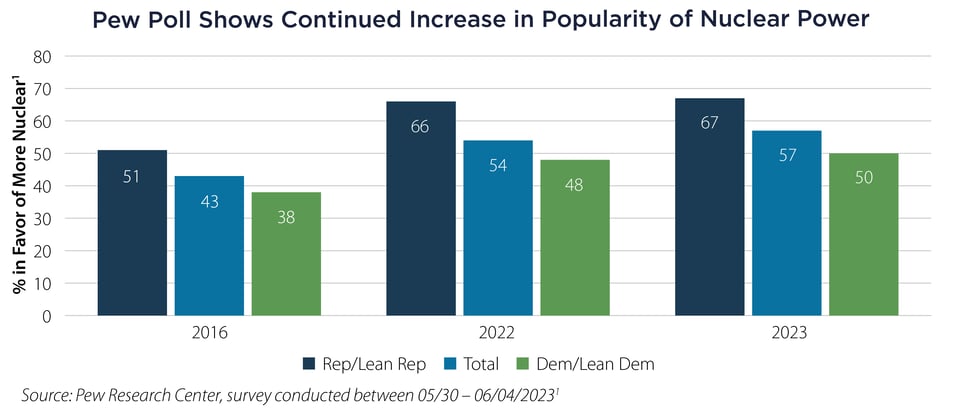

A Pew Research Center poll published on August 18th shows that support for nuclear energy in the US continues to grow, with the percent in favor comfortably over 50%.1 While there is still a significant spread between the major political parties, support among Democrats and Democrat-leaning independents is now at half of respondents, possibly due to the current administration’s recent legislation that carves out funding for nuclear energy.

Pew also points out that the spread between the parties for nuclear is less than for any other source included in the survey. For example, coal mining support has a 47 point “in favor” spread between Republicans (63%) and Democrats (16%), and other traditional energy forms are similar. With only a 17 point spread for nuclear, this seems like a clean energy opportunity that could enjoy enduring bipartisan support.

Funding

One of the biggest hurdles for nuclear energy is the high upfront costs, which have a history of overshooting projections.2 This high initial outflow means it takes a long time to become cash-flow positive, making favorable financing and cash flow stability key to the profitability of the project.

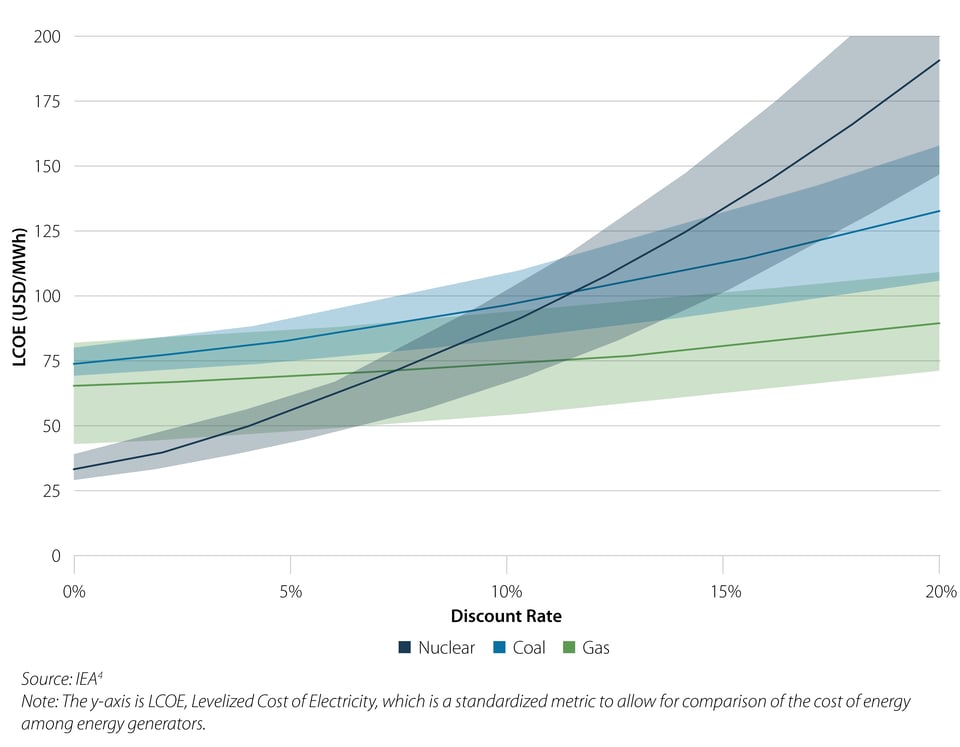

According to a 2020 joint IEA/NEA report on the costs of electricity generation, nuclear energy is the cheapest source of electricity when the discount rate is low and the most expensive form of energy when the discount rate is high.3 One key component of this analysis is the lifetime of the plant, and an extension of nuclear plant lifetimes by 20 years would significantly improve the economics of nuclear plants.

Three recent pieces of legislation, the Inflation Reduction Act (IRA), the Bipartisan Infrastructure Bill (BIL) and the CHIPS and Science Act, contain direct funding and loan programs to assist with the burden of high upfront costs, including funding for research into new technologies. The IRA also contains tax credits that go into effect if energy prices fall below a certain level, which decreases the downside risk to recurring cash flows.2

Technology

The high upfront costs are also being addressed through innovation. Small modular reactors (SMRs) aim to bring down costs through scalability and standardization. SMRs are small—some small enough to fit in a shipping container—and self-contained, making them easier to produce, transport and maintain.

Some versions of these reactors are capable of processing more-refined fuel than most large nuclear power plants use today, making them much more efficient. They are also inherently safer, due both to their size and to technologies developed after most of the US reactor fleet was already constructed.2

Investor Perspective

Nuclear power plant construction is far less mineral intensive per megawatt (MW) of capacity than other clean energy alternatives, which means new plants may actually become more competitive due to the constraints we anticipate in certain commodity markets.

On the other hand, the US and EU import most of their uranium, and major vendors include Niger, which just experienced a coup, and Russia.5,6 While variable costs as a percent of total costs are low for nuclear plants, these plants still have to pay for their fuel source (unlike solar or wind), so disruptions to uranium markets increase operating costs.

Further up the supply chain, this increase in geopolitical tensions coupled with increased interest in nuclear energy could bode well for uranium miners in West-aligned countries.

While nuclear energy popularity in the US has lagged behind other clean energies, we believe there may be sufficient support for a resurgence of investment in the space. At the same time, recent legislation and technological advances are helping improve financial feasibility. Firms involved in the space, both on the fuel side and the power generation side, may stand to benefit as the global energy transition marches on.

Important Disclosures & Definitions

1 Leppert, Rebecca and Brian Kennedy, "Growing share of Americans favor more nuclear power", Pew Research Center, August 18, 2023.

2 Geverkyan, Arkady, Edward Morse, Anthony Yuen, Keith Tuffley, Serge Tismen, Ryan Nielson, Ian Chapman, David Gann and Ernest Moniz, “Future of Nuclear Energy in a Low-Carbon Environment”, Citi Institutional Clients Group, July 26, 2023.

3 Lorenczik, Stefan, and Jan Horst Keppler, Projected Costs of Generating Electricity, Organization for Economic Cooperation and Development, 2020 Edition.

4 International Energy Agency (IEA), "Sensitivity of LCOE of baseload plants to discount rate", IEA, Paris, License: CC BY 4.0.

5 “The Coup in Niger Could Add Further Tightness in Uranium and Energy Markets”, 13D Research & Strategy LLC, August 3, 2023.

6 “Where Our Uranium Comes From”, U.S. Energy Information Administration (EIA), July 7, 2022.

Megawatt (MW): one million watts of electricity.

AAI000403 08/29/2024