What does ‘Higher for Longer’ Mean for the Real Economy?

In a recent piece, my co-CIO Alex Hagmeyer discussed our near-term view that the US economy is poised for reacceleration. Our belief is based on several factors, which include improving sentiment indicators and continued strength in structural elements like the Wealth Effect, Labor Markets and US Fiscal Policy. Despite the prevailing market narrative that suggests prolonged higher interest rates will crash the economy, we believe that this perspective will lose steam as the economy and corporate profitability remain robust.

While we hold this positive market view, we are also aware of the potential long-term impact of sustained high interest rates on the real economy. As such, we've decided to delve into the transmission paths through which higher rates can affect the real economy, and our Multi-Asset Research Team is closely monitoring these factors.

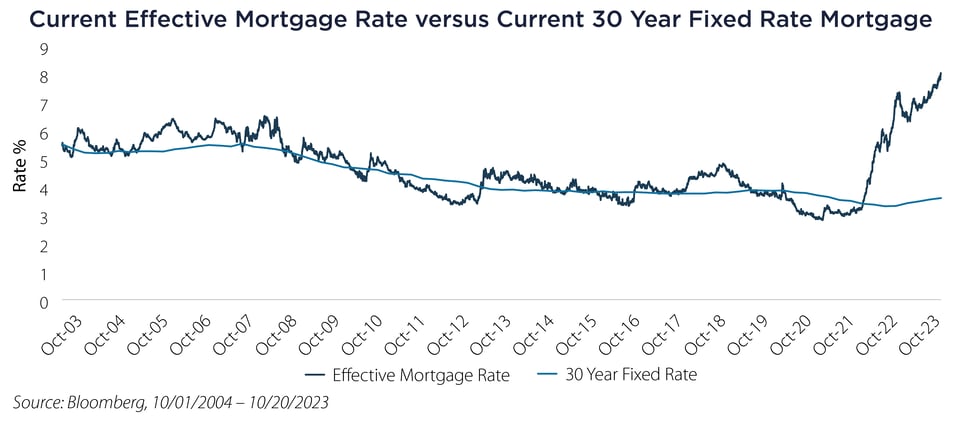

- Housing: The US Housing market is valued at approximately $52 trillion1 and represents many US consumers’ largest asset and often their largest liability. A substantial portion of the $13.767 trillion mortgage market has locked in rates below 4%. However, new 30-year mortgages have recently reached 8%. In this context, it's the turnover in housing that matters, as new homebuyers bear the full impact of higher rates, increased homeowners' insurance costs and property taxes.

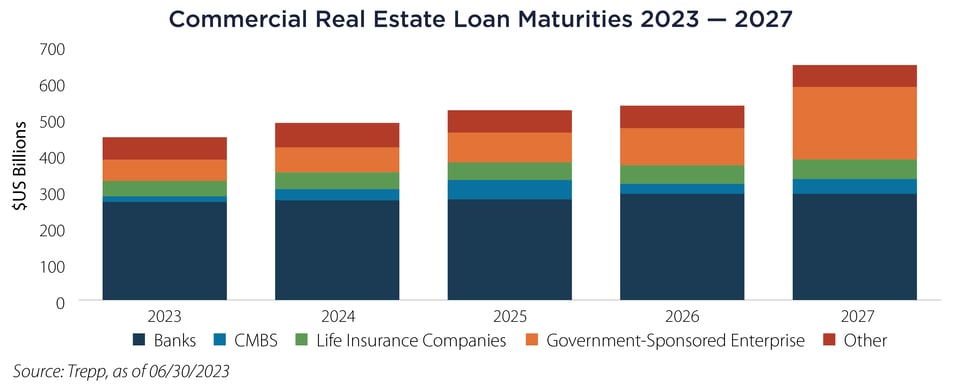

- Commercial Real Estate (CRE): There are around $5.8 trillion2 in CRE loans outstanding along with an additional $1.461 trillion (with leverage on top) managed in Private Real Estate funds as reported by McKinsey.3 Most CRE loans have a five-year term, implying that roughly 10% to 20% of the outstanding base resets every year. We anticipate that the wave of debt maturities in CRE over the next few years will prompt a reevaluation of properties. Borrowers may need to afford higher payments, or lenders may need to restructure the debt. We are closely monitoring CRE refinancing in response.

- Leveraged Finance (High Yield Bonds and Bank Loan Debt): The US Leverage Finance market has a total value of about $3 trillion4, split between High Yield bonds and Leveraged Loans, in addition to roughly $1.3 trillion in Private Debt funds under management. Similar to Real Estate loans, terms typically range around five years, with a significant portion exposed to floating rates.

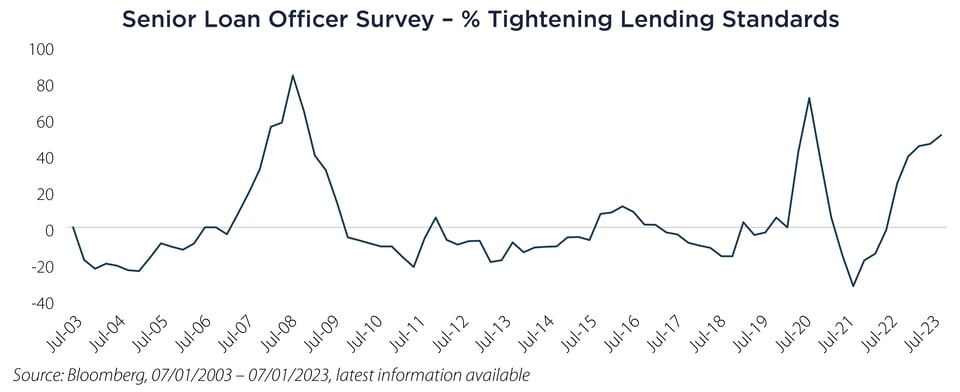

- Banks: While the higher cost of deposits does impact bank profit margins, we are more concerned about credit availability. Rising rates can stress borrowers, lead to increased loan losses and cause banks to reduce lending. Bank lending is essential for a healthy and growing economy, and any slowdown in lending can hinder economic growth.

Clearly there are other avenues where interest rates impact the economy. However, these four transmission channels are the most significant. Let’s explore each a little deeper focusing on what we are watching.

Housing

Over the past 20 years the outstanding effective mortgage rate has tracked fairly close to where new mortgages originated. However, that linkage was blown apart when the Federal Reserve began the current aggressive tightening cycle. In a higher for longer world, all else equal (including home prices), Americans are going to have much higher monthly mortgage payments as homes are sold and bought.

Commercial Real Estate

We anticipate that the wave of debt maturities in CRE over the next few years will prompt a reevaluation of properties. Borrowers may need to afford higher payments, or lenders may need to restructure the debt. We are closely monitoring CRE refinancing in response and believe projects will need a much higher return to support the same amount of debt in a higher for longer world.

Leveraged Finance

Currently, the High Yield Bond default rate is slightly above 3%, and the Leveraged Loan default rate is just below 2%. While these rates are near long-term averages, they have been trending higher over the past six months and are expected to continue rising through 2024. This trend is of great concern because defaults can lead to company closures or, more commonly, cost-cutting measures. We believe there is a strong connection between corporate defaults and unemployment during the next economic cycle.

Banks

Finally we have banks – the world’s financial plumbing. Here we have three primary areas of focus, including ability to lend, willingness to lend and the core functioning of the banking system. The Senior Loan Officer Survey above is an example of banks’ willingness – or in this case unwillingness – to lend to corporate clients. If we see default rates rise in either CRE loans or Leveraged loans, bank reserves would rise and negatively impact banks’ ability to lend. We are watching how the banking system is functioning very closely.

Impact of Higher for Longer

In conclusion, we recognize the need for a balanced approach to investing, considering both the present and the future. While we remain optimistic about the current reaccelerating economy, we are realistic about the long-term impact of the Federal Reserve's "Higher for Longer" policy. By identifying the transmission mechanisms into the real economy, contextualizing these channels and monitoring the right data, we aim to maintain a positive outlook today while staying grounded in our expectations for the future.

Important Disclosures & Definitions

1 “The Value of Residential Real Estate Broke a New Record $52 Trillion” – Zillow, September 26, 2023.

2 “Commercial Real Estate Debt Universe Grows 5.9% Annually in Q2 2023” – Trepp, October 11, 2023.

3 “McKinsey Global Private Markets Review: Private Markets Turn Down the Volume” – McKinsey, March 21, 2023.

4 “The US Leveraged Finance Market Is At A Record $3 Trillion” – Forbes, August 10, 2021, latest information available.

AAI000586 10/24/2024