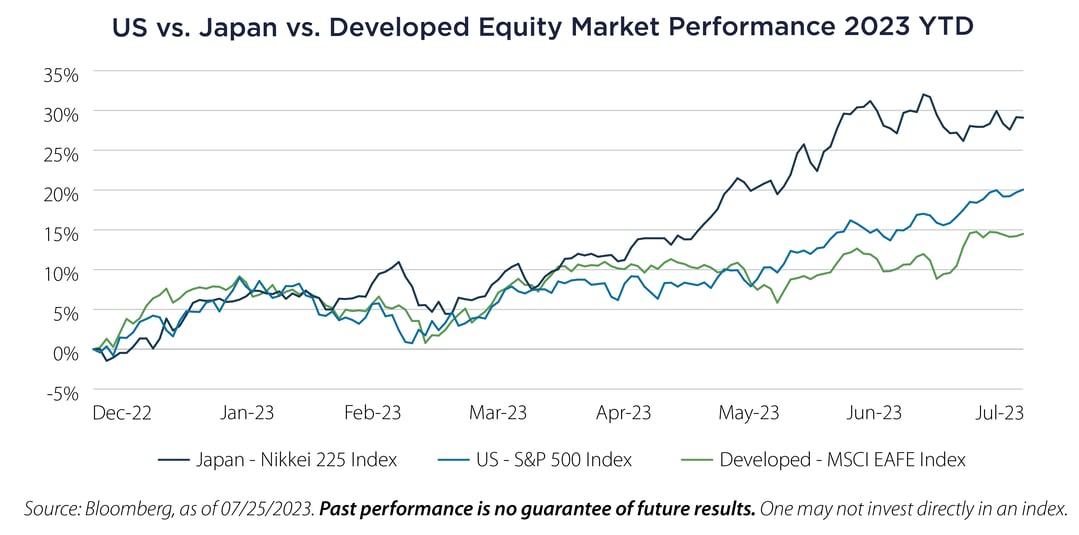

Around this time last year we highlighted the divergent yield curve control (YCC) policy of the Bank of Japan (BOJ) relative to other global central banks. Since then, the Japanese stock market has outperformed all other major developed markets year-to-date (YTD) with signs of continued strength. Although US developments will continue to drive the global narrative, exposure to Japanese tailwinds could be a source of excess returns (vs. just a diversification of risk in a global portfolio).

Tailwinds

Tailwinds

The recent outperformance is not just a transitory trade but fundamental validation of investor-friendly structural reform.

The lack of capital efficiency of Japanese companies has a well-known history that has created friction to foreign investment and general market underperformance. But recent reform has been catalyzed directly by the Tokyo Stock Exchange (TSE) that is requiring listed companies that trade below book value to provide an improvement plan.1

The impact is significant – almost half of the prime market trades below book, and approximately a third of Topix 100.2 This necessitates cash deployment (e.g., share buybacks) and/or focus on management of operations going forward.

Along with, and due to, reform, inflows to Japanese equities have increased, including Warren Buffet’s recent investments in the major Japanese trading houses.3 Concurrently, the new BOJ Governor Ueda is reviewing normalizing monetary policy as inflation is above target and supportive of domestic economic activity.

Remarks

These, along with a tenable devalued currency, continue to support Japanese market optimism. Barring exogenous pressures, particularly associated with the US, Japan could continue to see market outperformance and should be considered in the context of a global equity portfolio.

Important Disclosures & Definitions

1 Tokyo Stock Exchange: Action to Implement Management that is Conscious of Cost of Capital and Stock Price, March 31, 2023

2 Bloomberg News: Tokyo Bourse’s Buried Notice Spurs Surges in Cheap Japan Stocks, February 22, 2023

3 Bloomberg News: Warren Buffett Raises Stake in Five Japanese Trading Houses, June 19, 2023

MSCI EAFE Index: an equity index which captures large- and mid-cap representation across 21 developed markets countries around the world, excluding the US and Canada, covering approximately 85% of the free float-adjusted market capitalization in each country.

Nikkei 225 Index: tracks the performance of the top 225 companies that are listed on the Tokyo Stock Exchange.

S&P 500 Index: widely regarded as the best single gauge of large-cap US equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

TOPIX (Tokyo Stock Price Index): commonly known as TOPIX, the index tracks the performance of all domestic companies of the Prime market division of the Tokyo Stock Exchange. The TOPIX 100 tracks the performance of the TOPIX Core 30 and TOPIX Large 70.

One may not invest directly in an index.

AAI000314 08/01/2024