• Recently, India’s stock market surpassed Hong Kong as the fourth largest stock market in the world by market capitalization.

• India continues to enjoy structural advantages relative to other emerging market economies.

• With the strongest projected Gross Domestic Product (GDP) growth amongst the largest economies, these structural advantages could present a continued opportunity.

Early in 2023, we wrote about the long-term opportunity in India, driven by growth in a relatively young population, increasing consumer spending and investment friendly policy. By the end of last year, India had surpassed Hong Kong, becoming the fourth largest stock market by country in the world, trailing the US, China and Japan. At the end of the year India’s total market capitalization stood at just under $4.4 trillion, and approximately $1 trillion greater than the end of 2022.1

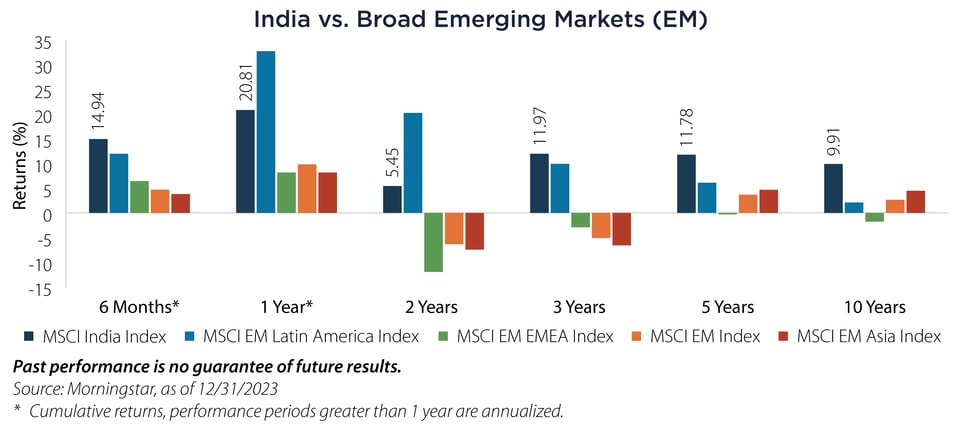

When compared to broad Emerging Market equity regions, India’s performance has been consistently attractive on six-month and one-year bases, as well as over the long term. Moreover, risk-adjusted returns have compared favorably to other Emerging Markets.

Notwithstanding this recent performance, we believe the long term opportunity in the country remains intact. Having surpassed China as the world’s most populous country, demographics remain a tailwind with a younger population. India is also looking to grow Foreign Direct Investment (FDI) into the country. After attracting about $70 billion in its 2022-2023 fiscal year, the government has set a goal of $100 billion in FDI annually over the next several years. In recent years, global companies such as Apple and Samsung have expanded operations.2

To be sure, India can continue to make improvements in such areas as transportation/logistics infrastructure and the ease of doing business. That said, in our view, India will likely continue to provide an attractive investment destination which could drive attractive risk-adjusted returns.

Important Disclosures & Definitions

1 CEIC, as of 12/31/2023.

2 Reuters, “India Eyes $100 Billion Annual Foreign Direct Investment in Coming Years”, 01/17/2024.

MSCI Emerging Markets (EM) Asia Index: captures large and mid-cap representation across eight Emerging Market countries (China, India, Indonesia, Korea, Malaysia, the Philippines, Taiwan and Thailand) in Asia. With approximately 1,200 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

MSCI Emerging Markets (EM) EMEA Index: captures large and mid-cap representation across 11 Emerging Market countries in Europe, Africa and the Middle East, including the Czech Republic, Egypt, Greece, Hungary, Poland, Qatar, Russia, Saudi Arabia, South Africa, Turkey and United Arab Emirates.

MSCI Emerging Markets (EM) Index: captures large and mid-cap representation across 24 Emerging Markets countries. With approximately 1,500 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

MSCI Emerging Markets (EM) Latin America Index: captures large and mid-cap representation across five Emerging Markets countries (Brazil, Mexico, Chile, Peru and Colombia) in Latin America. With approximately 100 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

MSCI India Index: designed to measure the performance of the large and mid-cap segments of the Indian market. With approximately 125 constituents, the index covers approximately 85% of the Indian equity universe.

One may not invest directly in an index.

AAI000589 01/23/2025