Sophie Mohler, SS&C ALPS Advisors Research Intern, is a rising senior at the University of Missouri studying Finance and Banking.

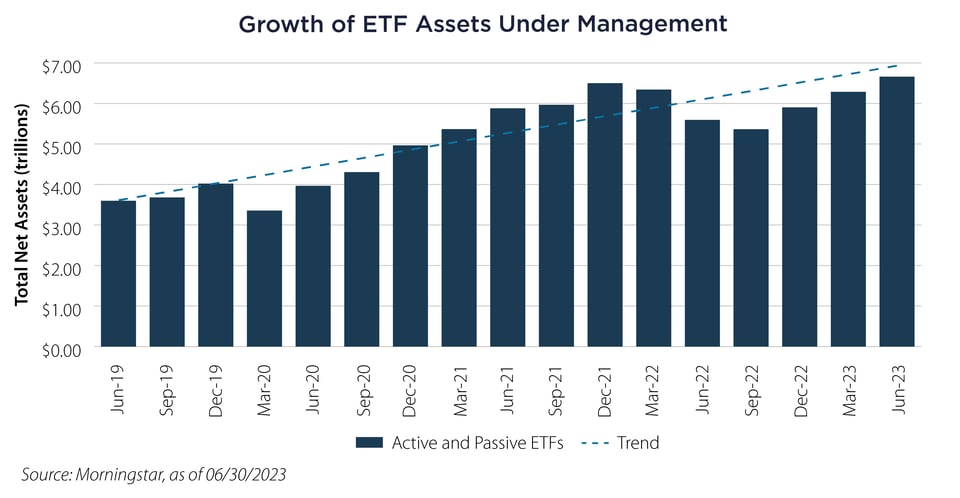

Exchange-Traded Funds (ETFs) just turned 30 in January of this year. Despite their youth they are revolutionary compared to their counterparts: mutual funds and separately managed accounts (SMAs). Assets in ETFs have grown 85% since June of 2019 (actively and passively managed ETFs combined) bringing total net assets to $6.66 trillion. By comparison, mutual funds have only grown 15% since June of 2019.1

ETFs are investment vehicles that pool securities to offer diversified access to an area of the market. Like mutual funds, ETFs can invest in stocks, bonds, commodities, currencies and derivatives. The first ETFs were designed to track a benchmark index (such as the S&P 500) but in recent years we are seeing growth in actively managed ETFs. Assets in active ETFs have grown 39% since June of 2022.1

Do not confuse them with mutual funds: the main difference is that ETFs list and trade throughout the day on a stock exchange like a single stock. Along with this, they have many benefits that make them appealing and contribute to this rapid growth, such as tax efficiency, transparency and generally lower expense ratios than mutual funds.

But if these investments are so revolutionary, why are they barely taught in school? Probably because textbooks struggle to keep up with the times. It took the US Securities and Exchange Commission's "ETF Rule" (6c-11) of 2019, which created certainty and consistency, to see substantial growth in ETFs. 6c-11 leveled the playing field by codifying regulations and removing the necessity to obtain exemptive relief. Along with the Vanguard patent expiration this May, which opens up opportunities for other mutual fund managers to create ETFs as a share class, we may see a boost in ETF asset growth in the future.

This is a message to college students/new investors/old investors explaining why you should be investing in ETFs:

1) Inexpensive

College students are known for having low to no income and low savings (all those bills to pay). It is best to improve your income while keeping fees low. ETFs typically have lower expense ratios than mutual funds. In addition, due to their structure, capital gains are recognized when the ETF is sold whereas mutual funds pay capital gains distributions once a year. More capital gains distributions means more taxes for you, which could even happen in down years! Finally, you are less likely to have to pay commission fees. All in all, lower fees, lower trading costs, lower tax bills. Cheaper.

2) No minimums

Unlike most mutual funds, there is no minimum amount required to invest in an ETF which lowers the barrier to investing. Minimums for mutual funds can range up to $3,000. This is not ideal for a student with low income and high debt. ETFs are slightly less daunting as you could invest even as little as the price of a beer, $8. Everyone knows the benefit of starting to invest early but this can be difficult with new expenses post-graduation in addition to any previous debt. Start with one less drink per week and eight more dollars into ETFs.

3) Diversification

Rather than that eight dollars being put into an individual security that could heavily fluctuate based on security-specific risk, you could put it into a basket of securities for diversification – an ETF. With such a proliferation of ETFs over the years across so many asset classes, factors, market caps, themes and sectors, you can invest depending on your risk tolerance, preferred asset class and investment objective/style. ETFs are usually the lowest cost way to help you diversify risk while allowing you to invest in what you believe in. This brings you one step closer to reaching your long-term goals.

No matter your age and what you are looking for, there are benefits to choosing ETFs. Whether you are in it for the transparency, diversification or cost benefits, sit back and enjoy watching them grow.

Important Disclosures & Definitions

1 Morningstar, as of 06/30/2023

S&P 500 Index: widely regarded as the best single gauge of large-cap US equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization. One may not invest directly in an index.

AAI000387 08/08/2024