“A brilliant solution to the wrong problem can be worse than no solution at all: solve the correct problem.”

- Donald Norman, The Design of Everyday Things

Every year strategists at large investment firms revise their capital markets assumptions (CMAs). These expectations of risk, return and correlation for each asset class are generally a direct input to the construction of investor portfolios. Fatefully, these CMAs are based on pre-tax investment risk and return.

For individual retirement accounts where all investments held in the account experience the same tax treatment, these widely available CMAs may be adequate. But for long-term investors with a distribution of wealth across account types, following these expectations blindly can misalign portfolios from their objective.

As discussed in last week’s TMT, asset location is a valuable tool for financial advisors. This is the process of optimally locating the assets of a predefined portfolio across accounts with varying tax treatment in order to maximize after-tax returns. Coupled with proposal generation, this can singlehandedly convert prospective wealth clients and accelerate organic growth.

Taking this one step further, invoking an investor’s after-tax risk and return estimates in the construction of a personalized portfolio can significantly differentiate the advisory experience. Here’s why: after-tax risk management can look very different than pre-tax risk management.

Taxation affects risk management because the government acts as a risk-sharing partner. Let’s consider a long-term capital gains rate of 20%. A pre-tax expected return and standard deviation of 5% and 10% translates to 4% and 8%, respectively, after-tax. But the risk input to portfolio optimization is variance (standard deviation squared). In this case, the pre-tax and after-tax variance are 1% and 0.64%, respectively. So while taxation reduces the return estimate by 20%, it reduces the variance estimate by 36%. This means the attractiveness of risky assets relative to the risk-free asset is increased with taxation as taxes have a volatility dampening effect on returns.

Mechanically, the event of capital loss in a given year can be carried forward to be used as a credit against future gains. This credit dampens the actual after-tax downside experienced by creating an asset to be used in the future. As a result, active tax-loss harvesting continuously dampens pre-tax volatility.

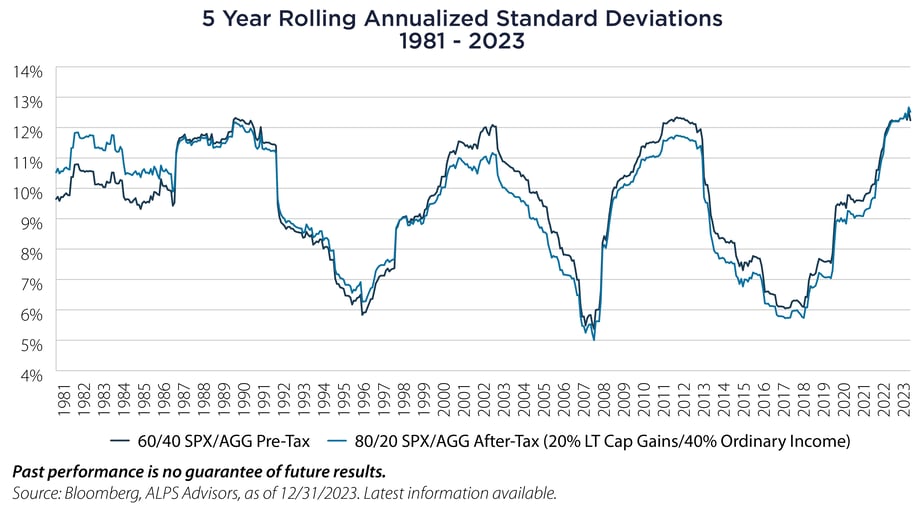

Let’s use an example to illustrate. In the below chart, we’re comparing historical 5-year realized rolling standard deviations of two multi-asset portfolios, rebalanced monthly. The first is a traditional pre-tax return 60/40 combination of the S&P 500 Index and the Bloomberg Aggregate Bond Index. The second is an 80/20 combination of the same indices using their respective estimated returns net of tax, assuming a 20% long-term capital gains rate and a 40% ordinary income rate. With respect to realized risk, the two portfolios are nearly right on top of each other and maintain a 20% difference in equity allocation weights.

The implication here is that the after-tax lens matters a lot to asset allocation, particularly because investment goals are only funded in after-tax dollars. Thinking in terms of after-tax risk management may point to increasing the overall portfolio risk level of a taxable investor with a true long-term horizon. And if tax rates were to rise in the future, personal risk budgets may need to rise as well.

For investors with distribution of wealth across multiple account types, the solution is not as clear cut, but that’s where optimization can help. Asset allocation and asset location can be solved simultaneously by viewing each candidate account-asset pair as an investable option, each with their own after-tax risk and return. After incorporating the goals of the investor and any additional risk tolerance constraints, after-tax wealth optimization is the correct problem to solve.

Here are some final thoughts for the advisory practice given the implications of after-tax investing:

- Risk tolerance questionnaires have become a simple way to dictate model portfolio assignment, but in our view they rarely take into account personalized, after-tax volatility and drawdowns. Staying attentive to the investor’s distribution of after-tax returns can help further align actual portfolio outcomes to the investor’s objectives and risk tolerance.

- Automated tax-loss harvesting is one of the fastest growing areas in wealth management. In direct indexing implementations, portfolios are optimized to track returns of a broad market index on a pre-tax basis. These accounts become problematic when they bump up against predefined asset allocation constraints and all or most assets in the account become low basis stock. One way to temporarily ‘unlock’ these accounts is to revisit these accounts’ after-tax risk contribution. To the extent they are under allocated on an after-tax basis, there is an opportunity to extend the useful life of these accounts by resuming cash infusions and creating higher basis tax lots.

- Goals are funded in after-tax dollars. Estimating a financial plan’s success with simulations based on pre-tax capital markets assumptions for retirement accounts may be adequate, but the introduction of a large taxable asset base can lead to missed expectations. After-tax risk and return parameters are necessary for efficient asset allocation and accurate wealth planning.

Important Disclosures & Definitions

AAI000689 05/07/2025