With relatively little fanfare, OpenAI introduced the ChatGPT Large Language Model (LLM) on November 30, 2022. Within 60 days over 100 million users enrolled, setting off an unprecedented wave of Artificial Intelligence (AI) demand and optimism, and driving explosive growth in the valuations of Microsoft, Google, Facebook, Nvidia, Taiwan Semiconductor and other AI-related companies.

Within eight months of the start of this frenzy, global spending estimates on AI have grown from an afterthought to a projected $300 billion per year by 2026, according to International Data Corp.1 Much of this spending will be for AI-specific central processing units (CPUs) and storage, as well as the data centers to house them.

Data Centers and AI

To deliver the human-like interaction from these large AI language models, massive computing capabilities are required. Dedicated data centers, which are specialized real estate facilities with power, water and network connectivity to house CPUs and storage, are at the center of this AI growth cycle. AI applications such as machine learning and natural language processing require significantly more computational resources than traditional applications such as internet search, ecommerce and cloud storage. Likewise, AI models require immense storage capacity to house ginormous datasets for model training.

Data centers are unique real estate assets and selecting a location is a complex and time consuming endeavor. Critical requirements, which curtail economically viable locations, include:

- Access to cheap electric power and water

- Redundant internet backbone connectivity

- Room to build multiple 100,000 sq. ft. warehouse-style buildings (100+ acres)

- Access to major transportation arteries

Perhaps most importantly, data centers are significantly more expensive to develop than traditional real estate, as illustrated nearby. Data center development is 6X more expensive than warehouses, 5X vs. self-storage units and 2X vs. average commercial real estate projects. These high costs and site limitations have produced stable and relatively low levels of speculative development thus limiting the growth of supply.

Real Estate and Data Center Performance

Public real estate, in aggregate, has not participated in the rally since the ChatGPT launch, returning 0.45% vs. 13.08% for the S&P 500. With REIT Net Asset Value (NAV) premiums hovering 1,200 basis points (bps) below their 10-year average, the asset class suffers from growing negative sentiment and concerns over valuations, a wall of maturing debt, ability to refinance debt at higher prevailing rates, margins and income growth. Office and Retail REITs have been particularly vulnerable as changing tastes and preferences (work from home, ecommerce) have fundamentally challenged the viability of these sectors.

Data Center REITs have been a much different story. Since the launch of AI language models and other similar services last winter, Data Center REITs have been a bright spot in real estate, returning 16.38% and outperforming the S&P 500, as illustrated nearby.

With consequential location, access and cost barriers, data center supply growth will likely be muted with vacancies persisting in the low single digits. As noted above, AI spending is expected to grow to $300 million per year by 2026, so demand is likely to be robust for at least the next several years.1

Although valuations are up sharply, Data Center REITs are well positioned for growth with strong balance sheets, low debt levels, long debt maturity schedules and strong net operating income growth.

A Looming Risk

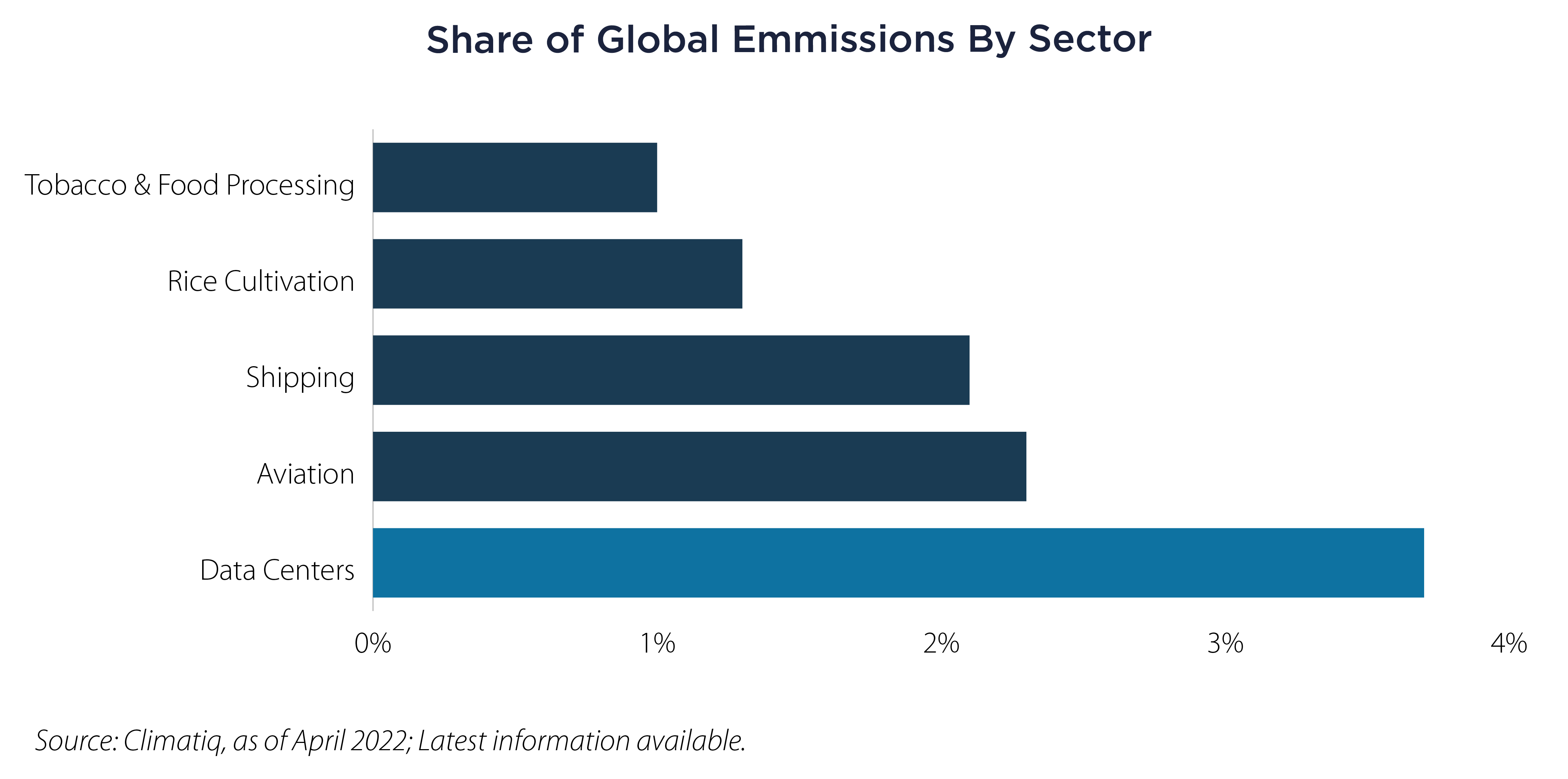

One significant risk facing data centers is the potential for environmental regulation at both the federal and local levels. As illustrated nearby, data centers, due to their massive electric power consumption, are one of the largest contributors of global emissions, with an output roughly equal to aviation and shipping combined. Growth from AI demand may only increase this disparity and heighten the level of scrutiny.

These potential regulatory actions may affect the cost of and/or access to power and water and could create limits on land use or facilities expansion, which could fundamentally alter the economics of data centers (and AI overall!) with negative impacts on the value of these assets. Although efforts are underway to build more efficient data centers, the resource demands from AI deployments appear to be outstripping current efforts thus far.

Regrettably, we appear to be at a point where an online jaunt to an AI-constructed virtual dreamland creates more environmental damage than an actual, in-the-real-world, journey.

Important Disclosures & Definitions

1 International Data Corporation (IDC) Worldwide Artificial Intelligence Spending Guide March 7, 2023.

FTSE NAREIT All Equity REITs Index: a free-float adjusted, market capitalization-weighted index of US equity REITs. Constituents of the index include all tax-qualified REITs with more than 50 percent of total assets in qualifying real estate assets other than mortgages secured by real property.

FTSE NAREIT Equity Data Centers Index: a subsector index of the FTSE NAREIT US Real Estate Index containing all Data Center REITs in the parent index.

FTSE NAREIT Equity Office Index: a subsector index of the FTSE NAREIT US Real Estate Index containing all Office REITs in the parent index.

FTSE NAREIT Equity Retail Index: a subsector index of the FTSE NAREIT US Real Estate Index containing all Retail REITs in the parent index.

S&P 500 Index: widely regarded as the best single gauge of large-cap US equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

One may not invest directly in an index.

AAI000311 07/25/2024