Background

A few different systems exist to incentivize companies to shift away from CO2-intensive1 practices, but the newest iteration is finally bringing the free market into the game. Carbon offset credits (or “carbon credits” or simply “credits”) have existed for some time as government-mandated programs. However, public sentiment on climate change has shifted to such a degree that companies are now participating in these markets just for the brand boost associated with claiming lower-than reality carbon emissions.

“Carbon offsets occur when a polluting company buys a carbon credit to make up for the greenhouse gas it has emitted. The money should be used to fund action somewhere in the world that removes the same amount of carbon out of the air, or to prevent carbon emissions.”

– World Economic Forum2

The goal of carbon offset credits is to channel funds toward sustainability projects. If an organization has a project that will remove carbon from the atmosphere, they can work with a regulatory body to have their project certified and eventually listed on a registry. Credits associated with the carbon reduction of the project can then be sold to another organization or company that wants or needs to reduce their carbon footprint. Proceeds from the sale will be used to fund the project, and the purchaser can claim a reduced carbon footprint.3

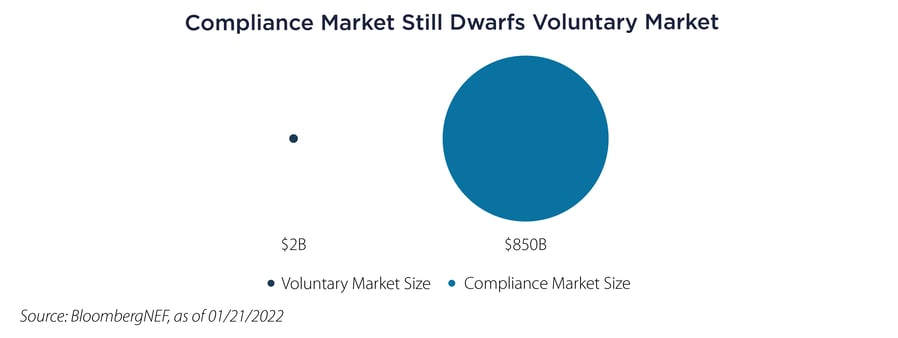

The two distinct markets that have emerged are known as voluntary and compliance (or mandatory) markets. The compliance market has relatively strict oversight, and credits from this market were prominently featured in the news recently when Tesla recorded a record $1.8 billion in revenue from sales of these credits.4 The voluntary market is more immature and has little oversight. However, big names we all know such as Meta, Apple and Google have begun dragging this market into the light with net zero commitments and purchases of hundreds of millions of dollars of credits.

The Opportunity

There are a couple features of the carbon credit markets that are particularly interesting as private markets get more involved. First, rapid growth in coverage is necessary for carbon markets to be fully commoditized. Second, there is significant room for innovation, both in the technology used in offset projects and in the commoditization of the product.

Private industry is able to move with speed not available to governments, so continued pressure from stakeholders to participate in climate change-combatting efforts could rapidly grow and improve carbon credit markets, with enhancements in voluntary markets spilling over into compliance markets. Currently, the situation is flipped, with compliance markets far ahead of voluntary markets, but we see potential for rapid advancement in voluntary markets.

Coverage and Critiques

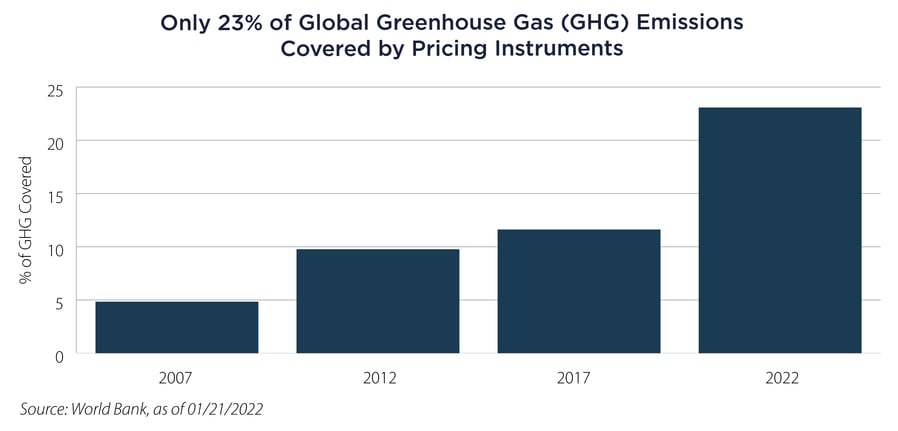

Only 23% of global greenhouse gas emissions are covered by pricing instruments, and the existing coverage is somewhat spotty.5 There has been extensive reporting on quality issues with carbon offset projects and credits in the voluntary market.6 While compliance markets generally have higher quality due to their extensive oversight, voluntary markets have very little regulation, making it difficult to know whether offset projects actually deliver what’s promised or if the credits have already been claimed.

Far from being a sign that the whole project is worthless, scrutiny on these voluntary offset projects is a natural step in the market’s life cycle. Stakeholders that caused the initial interest in voluntary offset credits will continue to press for higher quality offsets, and prices should converge somewhat between compliance and voluntary markets even if they don’t ever align exactly.

Predictions

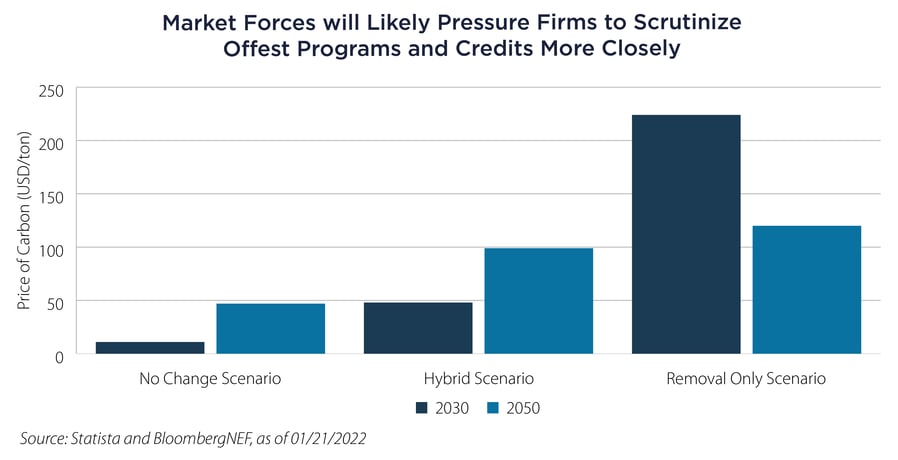

The above chart outlines scenarios envisioned by BloombergNEF (BNEF), a research arm of Bloomberg. In the “no change” scenario, there is no substantial increase in offset quality. The “removal” scenario is estimated based on only high-quality offsets that remove carbon from the air (as opposed to avoidance programs, e.g. “deforestation avoidance”).7,8 The “hybrid” scenario is a middle ground of the two.

We do not see the “no change” scenario as realistic, as stakeholders will likely stop giving companies recognition for offset credit purchases until there is a notable increase in the quality of the offset programs and credits. We therefore expect supply tightness, as new offset credits are more difficult to issue, and demand growth, as higher quality credits bring back stakeholder acceptance of offset credits.

Role in a Portfolio

At SS&C ALPS Advisors, we have long been interested in the global energy transition as a secular trend that will underpin the next commodity super cycle. In searching for the main beneficiaries of the trend, we use a constraints-based framework. We identify markets that may experience severe supply tightness as demand for new-world goods outstrips production (as in lithium) or as new production of old-world goods is no longer incentivized (as in oil).

Carbon may be considered the purest play in the energy transition, and it may also be the most constrained resource, as the entire objective is to decrease the supply of carbon. For this reason, we believe carbon may serve a role in a thematic model portfolio.

Important Disclosures & Definitions

1 “Carbon” is used throughout this piece (and the industry) to refer to CO2. “Carbon” is also often used, as it is in this piece, as a catch-all term for greenhouse gas emissions. This is due to CO2 enjoying unenviable fame as the face of the climate crisis. CO2 has also become the reference greenhouse gas, as other greenhouse gases are quoted in traded markets and projects as percentages or multiples of the warming effect of CO2 (known as CO2 equivalence or CO2E).

2 Pomeroy, Robin. “Carbon Offsets - How Do They Work, and Who Sets the Rules?” Interview with Rachel Kyte and Dharsono Hartono, World Economic Forum Radio Davos, podcast transcript. September 2, 2022. https://www.weforum.org/agenda/2022/09/carbon-offsets-radio-davos/.

3 This is a vast oversimplification of the process. For an in-depth understanding, including all the complications with oversight and verification, an excellent resource is www.offsetguide.org.

4 L, Jennifer. “Tesla Carbon Credit Sales Reach Record $1.78 Billion in 2022.” Carbon Credits, January 27, 2023. https://carboncredits.com/tesla-carbon-credit-sales-reach-record-1-78-billion-in-2022/.

5 World Bank. 2023. State and Trends of Carbon Pricing 2023. Washington, DC: World Bank. doi: 10.1596/978-1-4648-2006-9. License: Creative Commons Attribution CC BY 3.0 IGO.

6 “Airlines want you to buy carbon offsets. Experts say they’re a scam.” –JD Shadel, Washington Post

“Do Airline Climate Offsets Really Work? Here’s the Good News, and the Bad.” –Maggie Astor, New York Times “Not All Carbon Credits Are Created Equal. Here’s What Companies Must Know.” –Ken Silverstein, Forbes

7 Henze, Veronika. “Carbon Offset Prices Could Increase Fifty-Fold by 2050.” BloombergNEF, January 24, 2022. https://about.bnef.com/blog/carbon-offset-prices-could-increase-fifty-fold-by-2050/.

8 Avoidance programs are less desirable because they are generally lower quality. While the specifics of this are rather complicated, the core of the issue is verification of something actually being different because of the carbon offset program. Much of the criticism levied against carbon offset programs has been pointed at programs that are just for show (greenwashing) while actually consumption/production remain unchanged.

AAI000295 06/20/2024