• The fastest interest rate rise in modern history led to the downfall of multiple large banks, but the troubles did not end there.

• Banks are being squeezed on all fronts, including reduced lending capacity, the need to sell interest-earning assets and the necessity to raise deposit rates, resulting in financial challenges.

• Higher interest rates negatively impact bank asset values, forcing them to choose between selling newer, higher-yielding assets at par, and realizing losses on older, lower-yielding assets.

• Furthermore, potential risks from commercial real estate refinancing and stricter capital requirements further threaten banks’ profitability.

The fastest interest rate rise in modern history certainly took its toll on the banks. Even though post-Global Financial Crisis (GFC) laws mostly regulated banks out of credit risk, it turns out they should still consider managing duration risk. It all commenced with Silvergate Bank, which held liabilities in crypto deposits (short duration) and assets in mortgage-backed securities (long duration). As interest rates rose, these assets were worth less - which is a problem when depositors want their money back - and on March 8, 2023, Silvergate liquidated. Two days later, a similar bank run forced Silicon Valley Bank to close, and the FDIC was named Receiver. Soon followed Signature Bank on March 12th, and First Republic Bank was sold to JP Morgan & Chase for cents on the dollar on May 1st. And lest we forget, Credit Suisse collapsed and was purchased by Swiss rival UBS on March 19th. Since the start, this not-so-obvious, even in hindsight, catalyst ignited a 15%+ return from the S&P 500 Index and a 28%+ return from the tech-heavy Nasdaq 100 Index. Nothing to see here, folks ... go on with your day and keep moving along!

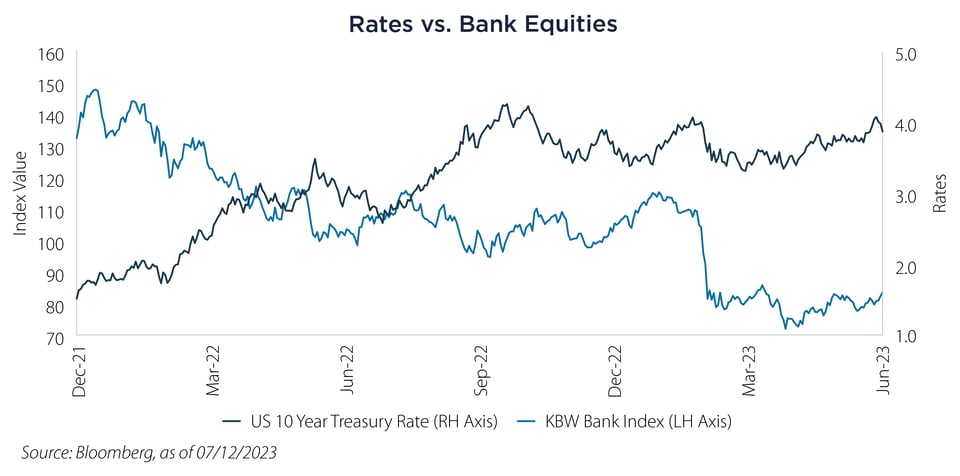

While the Federal Reserve acted quickly, establishing the Bank Term Funding Program (BTFP) to essentially insure all customer deposits and ease contagion (at higher costs to the banks), let’s not wave the all-clear flag just yet. Because although the stock market has been flying high, the banks are still not in great shape, and we see this in their stock prices. Currently, banks are being squeezed on all fronts, especially by higher interest rates. As we will soon hear from the banks to kick off earnings season, now is a good time for a quick review.

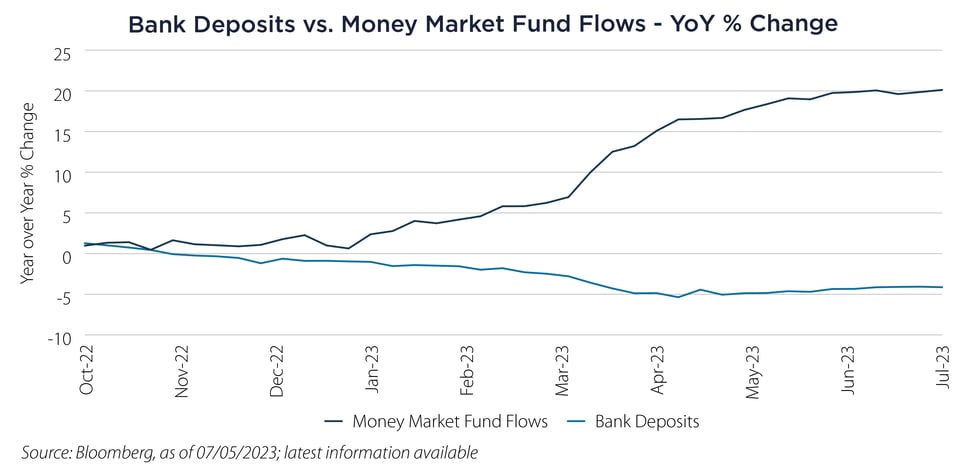

The fact is that nothing supports a bank like non-interest-bearing deposits. It’s literally like being given a bunch of money to invest and collect fees on without having to pay anything back – and when interest rates are near zero, no one demands too much interest on their deposits. However, when short-term interest rates rise above 5% things change, and that is where we find ourselves today. The following chart shows the outflow of bank deposits earning close to zero, compared to the inflow to money market funds yielding much higher rates. It’s an easy choice, a riskless 5% helps overcome the ever-present laziness of even the most inert investors.

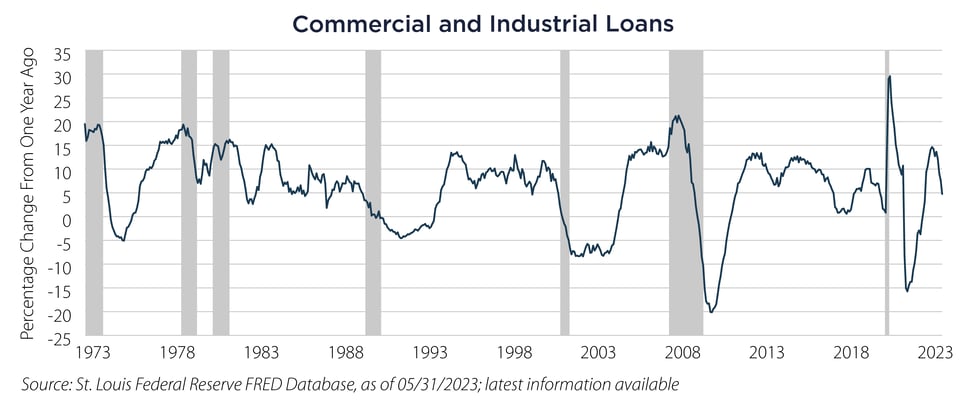

Shrinking deposits cause a few problems for banks: 1) They can’t make as many loans to maintain their leverage ratios - not that customer demand is strong anyway, 2) They have to sell interest-earning assets to accommodate deposit outflows and 3) They have to raise deposit rates to stop the deposit outflows. Basically, they have to pay more (to depositors) in order to make less (by transacting fewer loans). Right on cue, the National Credit Union Administration (NCUA) data for the first quarter showed that the cost of funds for credit unions increased faster than loan yield. We now see a fast deceleration in bank loans created that is consistent with past recessions.

Things don’t look much better when we look under the hood at their book values either. As previously mentioned, higher interest rates squeeze bank asset values. In a highly regulated, zero-interest-rate world, banks largely earn extra yield by investing in longer-duration assets, and rising rates diminish these asset values the most. So if banks are forced to sell assets to service deposit flight, they must choose between selling newer, higher-yielding issues trading at par, vs. realizing losses on older, lower-yielding issues trading at a substantial discount.

And this is all before we even consider the foreseeable refinance risk with regards to commercial real estate (CRE), or the likely stricter capital requirement regulations that would force banks to either raise capital, reduce the size of their loan portfolio or a combination of the two. Of course, these generalizations don’t apply to all banks – for example, global systemically important banks (G-SIBs) are far more insulated from deposit flight and have less exposure to CRE than the regional banks. But in short, in a world that is broadly insensitive to rising interest rates due to abundant fixed long-term debt, if inflation remains resilient, banks could feel the brunt of the pain.

Important Disclosures & Definitions

Performance data quoted represents past performance. Past performance is no guarantee of future results; current performance may be higher or lower than performance quoted.

KBW Bank Index: designed to track the performance of the leading banks and thrifts that are publicly-traded in the US. The Index includes 24 banking stocks representing the large US national money centers, regional banks and thrift institutions.

NASDAQ 100 Index: one of the world’s preeminent large-cap growth indexes. It includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

S&P 500 Index: widely regarded as the best single gauge of large-cap US equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

One may not invest directly in an index.

AAI000308 07/18/2024