Recently, tariff policy has driven much of market sentiment, as the broader economic outlook is closely tied to whether current trade measures are sustained or ultimately reversed. Since “Liberation Day,” markets have rebounded to all-time highs, and economic data has yet to reflect any significant deterioration.

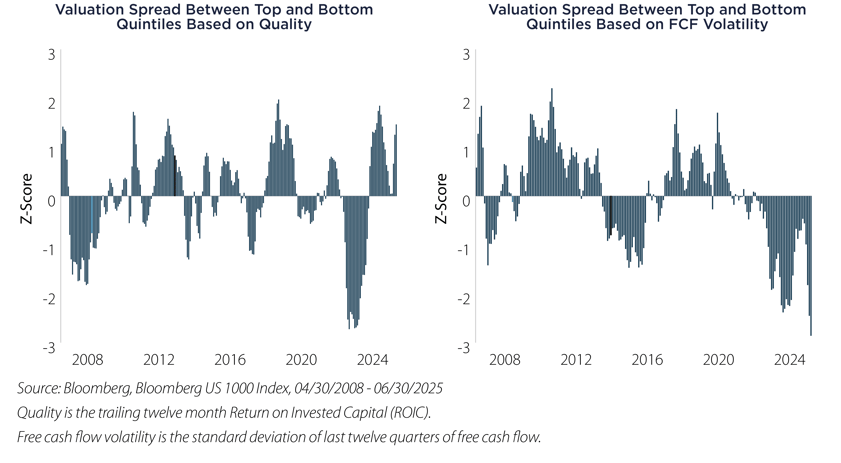

While the trajectory of tariff policy remains uncertain, recent market behavior exhibits a shift toward a more defensive positioning. From a factor perspective, we’ve seen a notable rotation into companies with stable free cash flow (FCF) and strong, high-quality fundamentals.

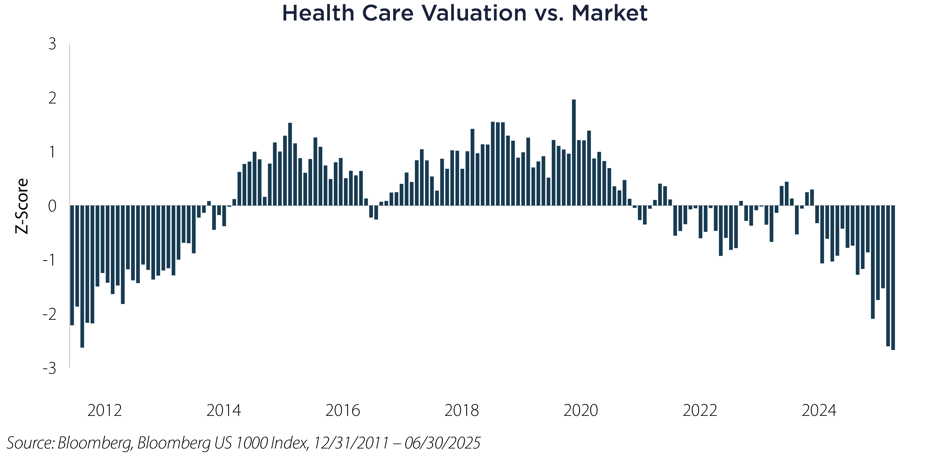

Surprisingly, despite this clear pivot toward stability and defensiveness, the health care sector has lagged. This underperformance appears to be driven by residual post-COVID-19 distortions and ongoing policy uncertainty under the new administration.

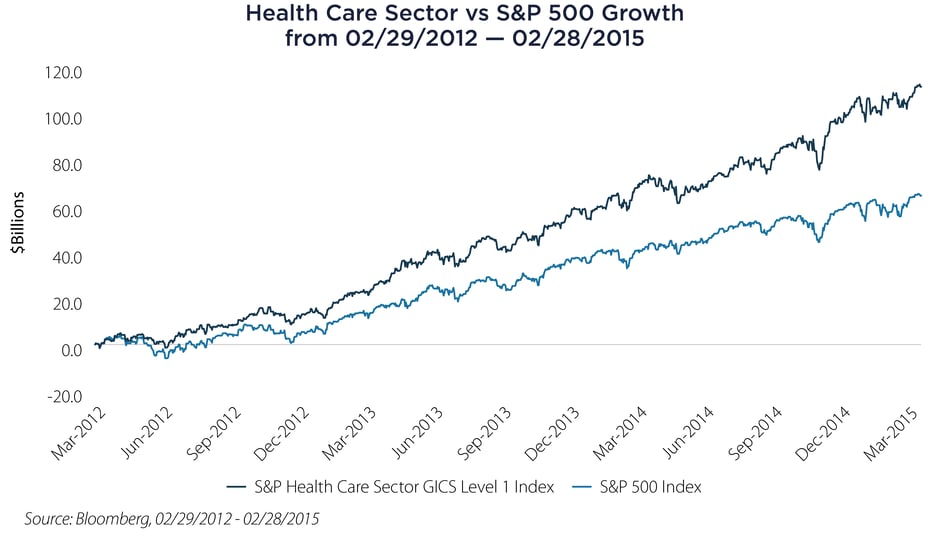

Nevertheless, health care remains a fundamentally robust, high-margin and traditionally defensive sector. Notably, the last time the sector traded at a similar discount to the broader market—in 2012—it went on to outperform by nearly 2x over the next three years. In our view, today’s valuation disconnect presents a compelling, overlooked opportunity in a sector with solid fundamentals and attractive asymmetric return potential.

Important Disclosures & Definitions

Bloomberg US 1000 Index: a float market-cap-weighted benchmark of the 1000 most highly capitalized US companies.

The S&P 500 Health Care Sector GICS Level 1 Index: a benchmark that tracks the performance of companies within the GICS (Global Industry Classification Standard) Health Care sector that are also constituents of the S&P 500 index. It represents a broad look at the health care industry's performance within the larger S&P 500.

S&P 500 Index: widely regarded as the best single gauge of large-cap US equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

Z-Score: a numerical measurement that describes a value's relationship to the mean of a group of values, measured as standard deviations from the mean. If a Z-score is 0, it indicates that the data point's score is identical to the mean score. A Z-score of 1.0 would indicate a value that is one standard deviation from the mean.

One may not invest directly in an index.

AAI000968 07/22/2026