In colonial India, British officials attempted to reduce the cobra population in Delhi by offering a bounty for every dead snake. The policy soon backfired as people began breeding cobras for profit. When the government discovered the scheme and abruptly ended the bounty program, breeders released their now-worthless snakes into the wild, causing an even worse infestation. Instead of solving the problem, the policy exacerbated it—illustrating how well-intentioned but poorly designed interventions can amplify the very issues they aim to resolve.

This phenomenon, known as the Cobra Effect, offers a valuable lens through which to examine recent economic policies intended to support “Main Street” over “Wall Street” as Treasury Secretary Scott Bessent continuously evokes.

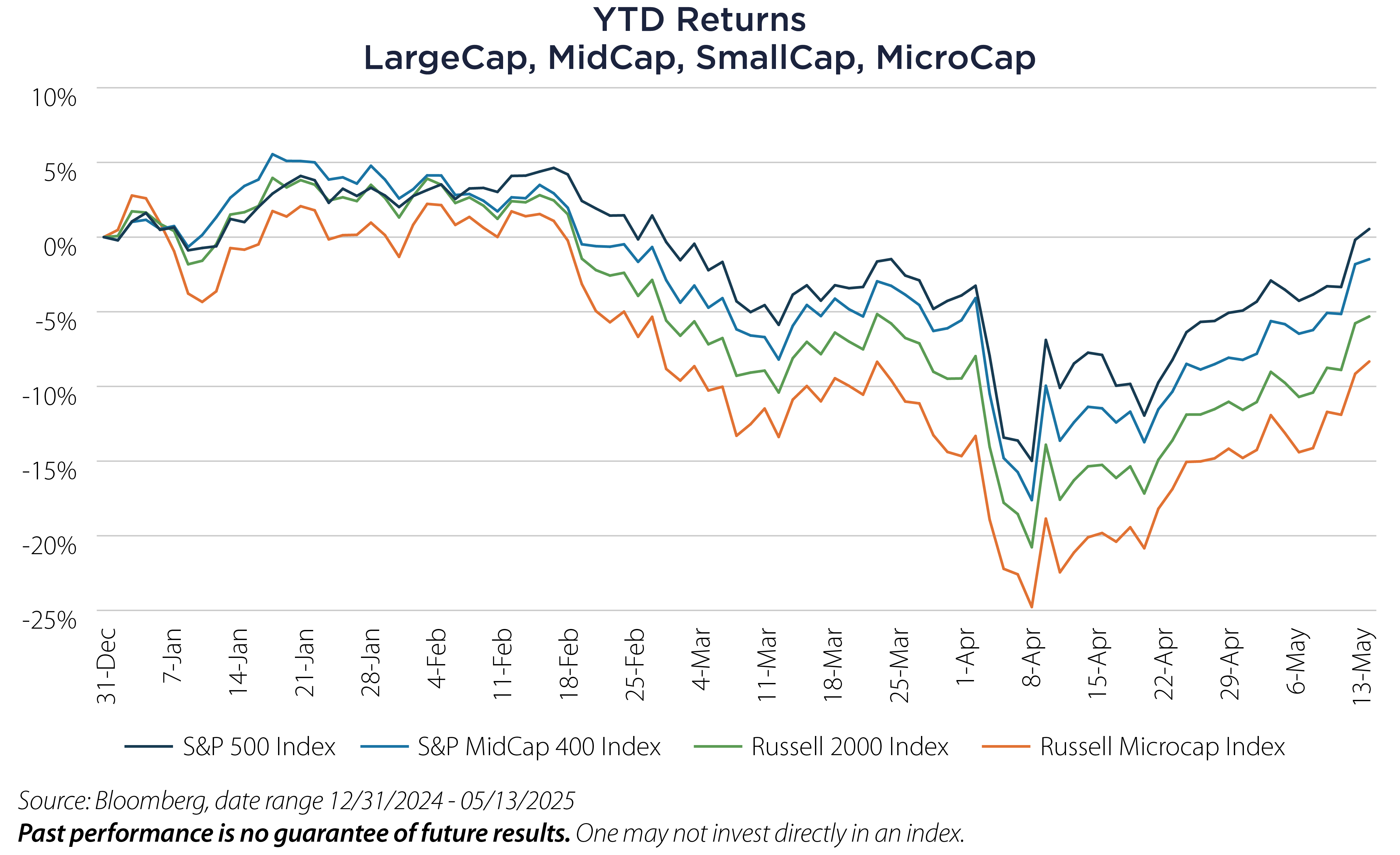

From our perspective, Main Street businesses have been particularly vulnerable to the current administration’s trade policy. One indicator of this is year-to-date stock index performance by market capitalization. As we can see, the smaller the capitalization the worse the performance.

This year the Russell Microcap Index currently shows:

- Upside Beta: 0.78

- Downside Beta: 1.23

This means microcap stocks underperform the S&P 500 Index on both up and down days. While microcap companies are not direct proxies for Main Street businesses, they share similar vulnerabilities—limited resources, cyclicality and reduced adaptability to policy shifts.

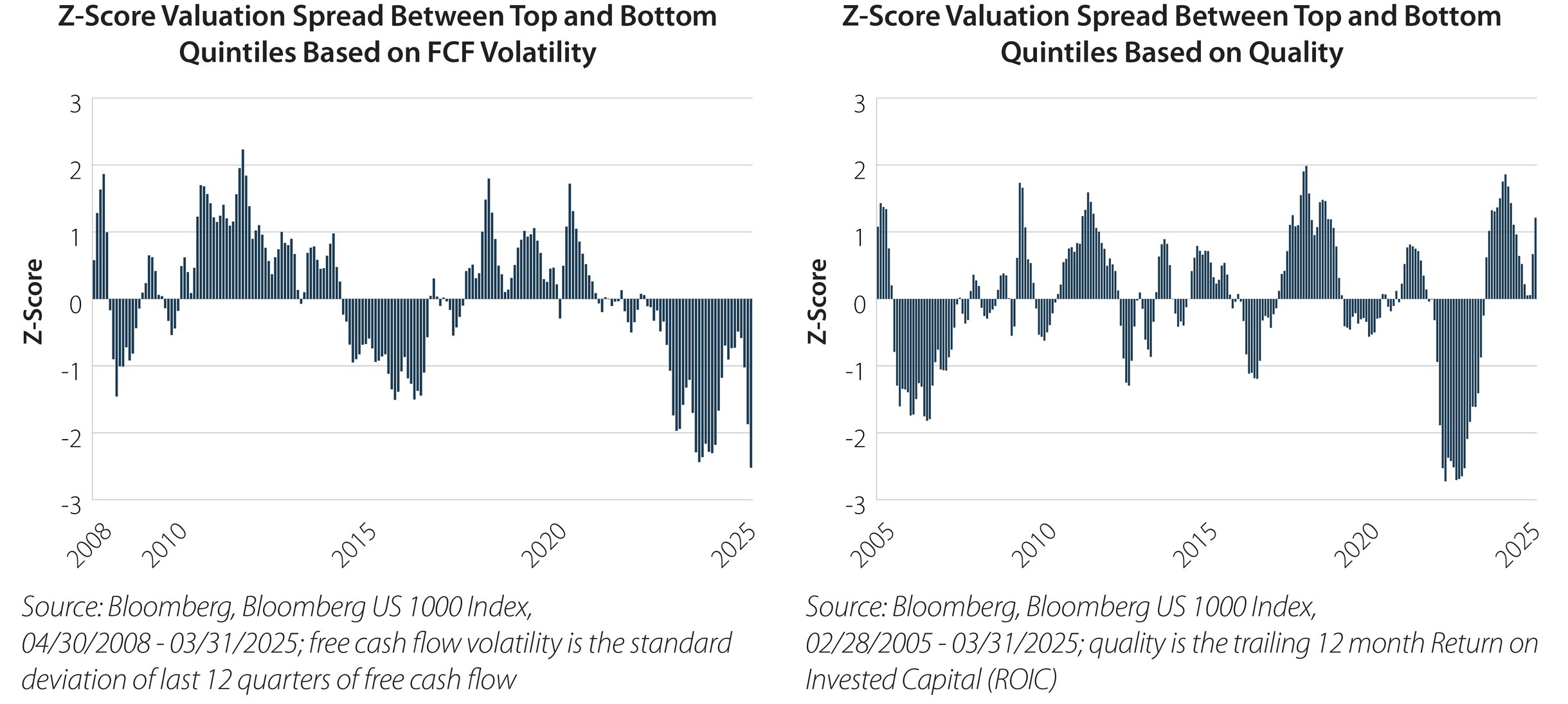

Another way to observe this impact is through the “flight to quality” trend seen this year. Investors have favored stable, high-quality businesses, which now trade at historic premiums compared to more cyclical firms.

The flight to quality and current valuation spreads may present a compelling investment opportunity in smaller and more cyclical companies. Since Liberation Day, the Trump administration has gradually rolled back tariff measures. If this trend continues, these more vulnerable businesses could experience a meaningful recovery and potential outperformance.

Important Disclosures & Definitions

Beta: a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market or a benchmark. The beta of the market or benchmark is 1.00 by definition. An investment with a beta above 1 is more volatile than the overall market, while an investment with a beta below 1 is less volatile. Downside beta is calculated on days when the market or benchmark's return is negative, while upside beta is calculated when it is positive.

Russell 2000 Index: measures the performance of the small-cap segment of the US equity universe.

Russell Microcap Index: measures the performance of the microcap segment of the US equity market.

S&P MidCap 400 Index: provides investors with a benchmark for mid-sized companies. The index is designed to measure the performance of 400 mid-sized companies, reflecting the distinctive risk and return characteristics of this market segment.

S&P 500 Index: widely regarded as the best single gauge of large-cap US equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

Z-Score: a numerical measurement that describes a value's relationship to the mean of a group of values, measured as standard deviations from the mean. If a Z-score is 0, it indicates that the data point's score is identical to the mean score. A Z-score of 1.0 would indicate a value that is one standard deviation from the mean.

One may not invest directly in an index.

AAI000941 05/20/2026