• Recent stronger than expected economic data and a surprise “two more hikes” signal by the Federal Reserve (Fed) has repriced the benchmark 10-year Treasury above the key 4% yield level once again.

• While we expect fixed income volatility to remain elevated during the typically less liquid “Dog Days of Summer”, we do not expect a repeat of the Summer of 2022 when 10-year yields soared 119 basis points (bps) following the Fed’s July 2022 hike1.

• As recession odds get pushed further into 2024, we reiterate our key positioning recommendations for the second half of 2023 – Stay Invested, Stay Protected and Stay Flexible.

The Dog Days of Summer

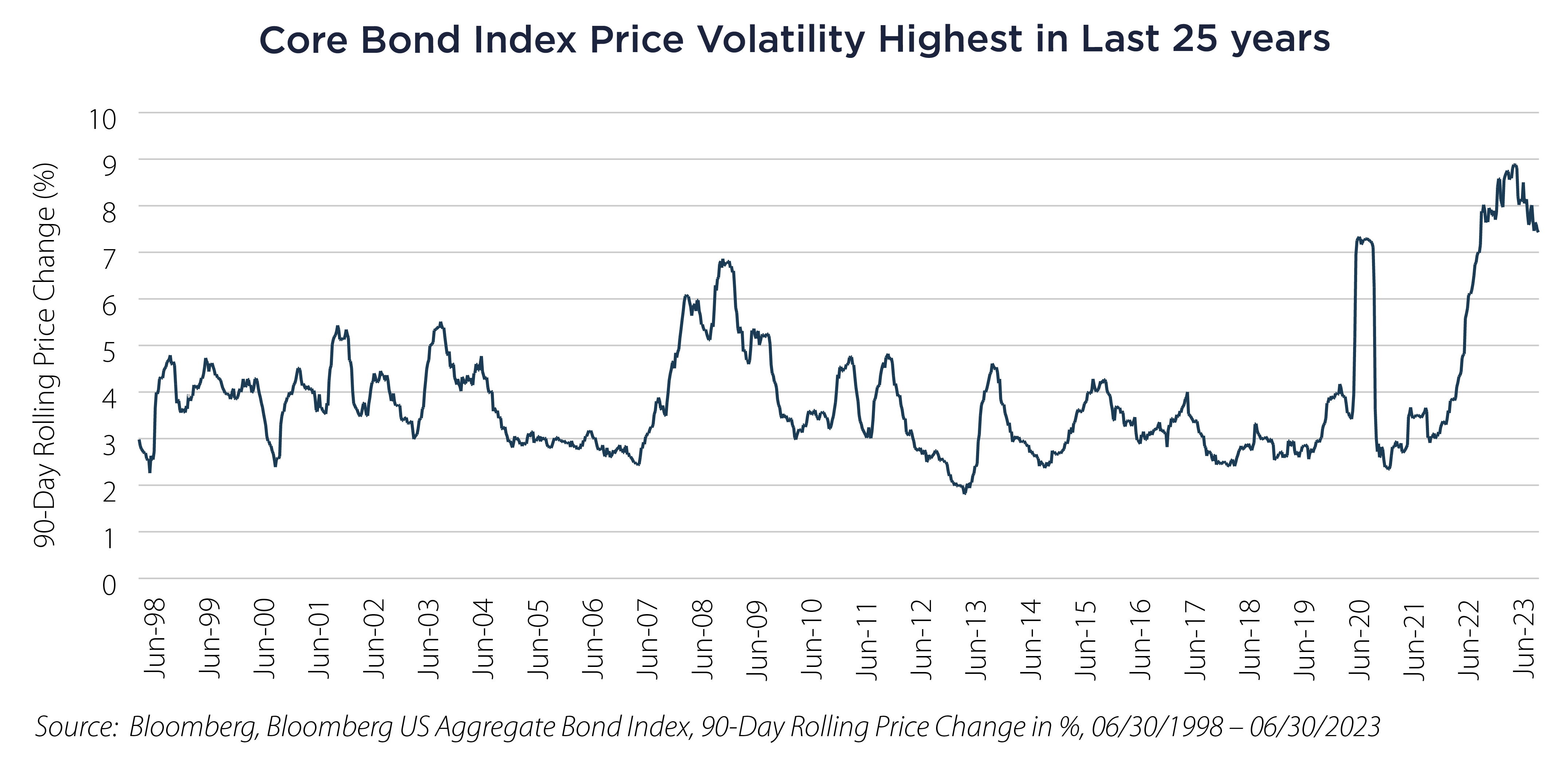

It is hard to believe we are already into the second half of 2023, entering the idiomatic “Dog Days of Summer” for the markets (July 3rd through August 11th). For the bond market these six weeks are typically characterized by thinner market liquidity and trade volumes as market participants take a break for the summer. With junior traders on the trading desks, armed with fresh Bloomberg logins, limited capital and stricter risk budgets, not much is going to happen. This year feels different though, as we are already sitting near the highest levels of Core Bond volatility in 25 years as the nearby chart illustrates. Is Bond Volatility Bad?

Is Bond Volatility Bad?

Unfortunately, bond volatility can be a harbinger of poor future returns for fixed income investors. However, compared to this time last year, the market landscape has changed – in a good way. The volatility drivers have abated as yields have risen across the curve and policy rates are now above core inflation levels.

| Variable |

Headed into Summer 2022 |

Headed into Summer 2023 |

| Core CPI (Inflation) |

6.1% and trending higher |

4.2% and trending lower |

| Unemployment |

3.6% stable to lower |

3.7% stable to higher |

| Real GDP |

-1.6% (Q1’22) |

2.0% (Q1’23) |

| 2-year Treasury Rate |

2.97% (07/06/2022) |

5.09% (07/06/2023) |

| 10-year Treasury Rate |

2.93% (07/06/2022) |

4.07% (07/06/2023) |

| Policy Rate/Signal |

1.75% aggressive 75 bps |

5.25% measured 25 bps |

Source: Trading Economics, most recent economic data closest to July of 2022 and 2023

We now have positive real rates in many parts of the yield curve and the market is on better footing to respond to unexpected data or policy surprises (in either direction), which could result in more predictable returns and lower realized volatility for the second half of the year.

The More Things Change the More they Stay the Same?

While the recent incoming data has been hotter than expected, it has served only to dismantle the recession case and rate cuts that were previously priced in for the second half of 2023. Both upside (slower growth, slower spending) and downside (inflation and growth reigniting) risks seem like plausible tail risks. As a result, we repeat our mantra from the beginning of the year – Stay Invested, Stay Protected and Stay Flexible.

Here is a short summary of what we mean:

• Stay Invested: Bonds play an important role in asset allocation and, despite higher-than-normal volatility, are still on track to deliver positive returns and offer attractive income and diversification properties.

• Stay Protected: We continue to recommend exposure to long-end Treasuries which offer the best protection for risk-off events. Higher quality (investment grade) securities are preferred and can continue to offer additional yield and diversification throughout the curve.

• Stay Flexible: Elevated volatility is providing more time and opportunities for active fixed income to outperform with yield curve and credit positioning. We continue to recommend barbell rates positioning, taking advantage of short duration yield opportunities, while underweighting the belly in a “higher for longer” scenario that plays out over this long, hot summer.

Important Disclosures & Definitions

Performance data quoted represents past performance. Past performance is no guarantee of future results; current performance may be higher or lower than performance quoted.

1 St. Louis Fed, Market Yield change on 10-Year US Treasury Securities (July 27, 2022 to September 27, 2022)

Barbell Strategy: allows investors to take advantage of current interest rates by investing in short-term bonds, while also benefitting from the higher yields of holding long-term bonds.

Basis Point (bps): a unit that is equal to 1/100th of 1% and is used to denote the change in a financial instrument.

Bloomberg US Aggregate Bond Index: a broad-based benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, fixed-rate agency MBS, ABS and CMBS (agency and non-agency).

Consumer Price Index (CPI): a measure of the average change over time in the prices paid by urban consumers for a representative basket of consumer goods and services.

Core Bonds: US investment grade bonds, including corporate, mortgage-backed, Treasury and agency debt.

Investment Grade: a rating that signifies that a municipal or corporate bond presents a relatively low risk of default. To be considered an investment grade issue, the company must be rated at 'BBB' or higher by Standard and Poor's or Moody's. Anything below this 'BBB' rating is considered non-investment grade.

One may not invest directly in an index.

AAI000304 07/11/2024