According to research, the average High School Senior can silently read about 250 words per minute. So, for our Two Minute Tuesday updates we try to target about 500 words. Sometimes that’s just not enough – or way too much – for our weekly snippet. The obvious way to share an insight more efficiently is to rely on pictures.

This week I wanted to share three pictures that tell a story of what’s happening in the US Sports Betting industry. The punch line is that the structure of the market, and the progression of data since state-level legalization was allowed in 2018 argues for sustainable secular growth. Equity investors love sustainable growth. This theme is worth keeping a finger on the pulse.

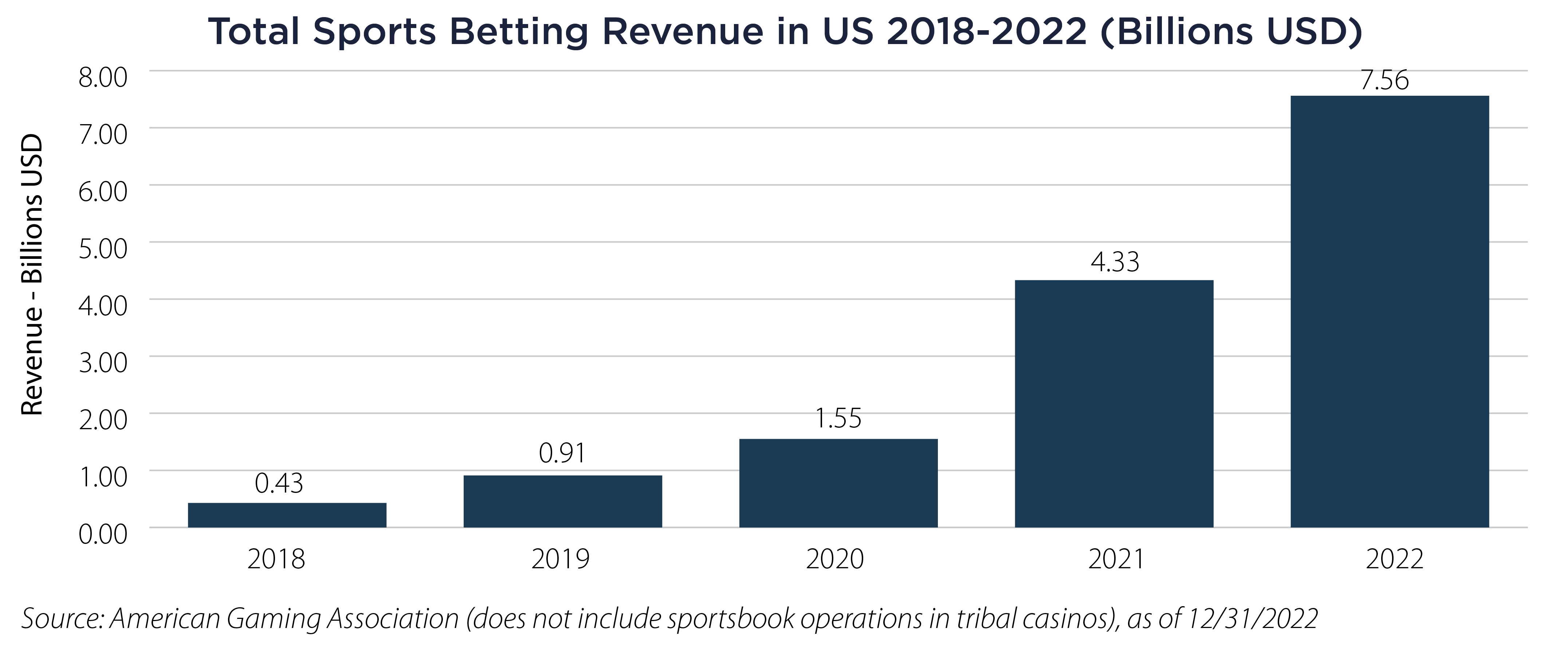

First, the most recent data on annual growth from the American Gaming Association shows substantial growth over the last five years – creating a greater than $7 billion market nearly out of thin air – and adding roughly $3 billion in revenue in both 2021 and 2022. Based on the growth rates of the public companies in the space, 2023 is on pace to add at least that amount.

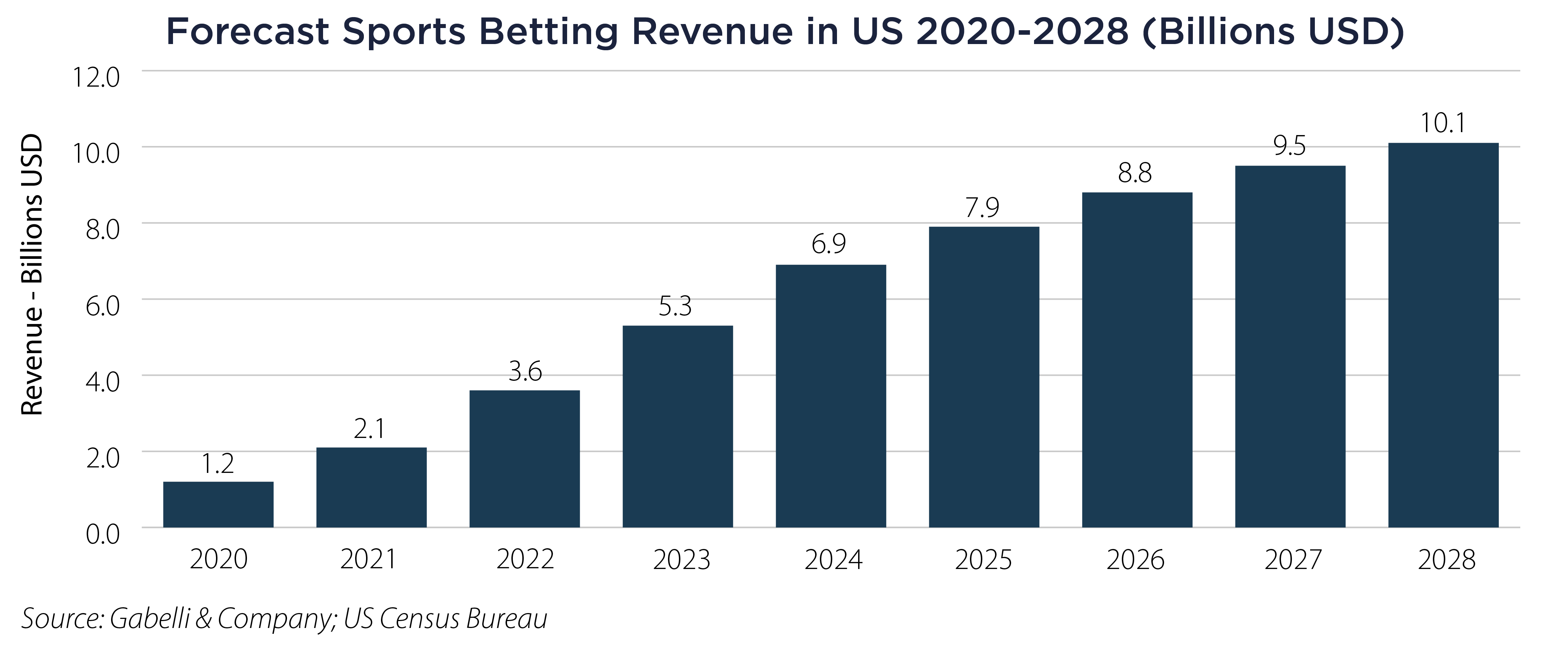

Second, and perhaps even more impressive for investors, is the pace at which actual growth has surpassed forecasts from two years ago. In 2021, the expectation was that sports betting revenue would be $5.3 billion by the end of 2023. The actual number is heading above $10 billion. It’s clear that the total addressable market is much larger than guessed only a couple of year ago.

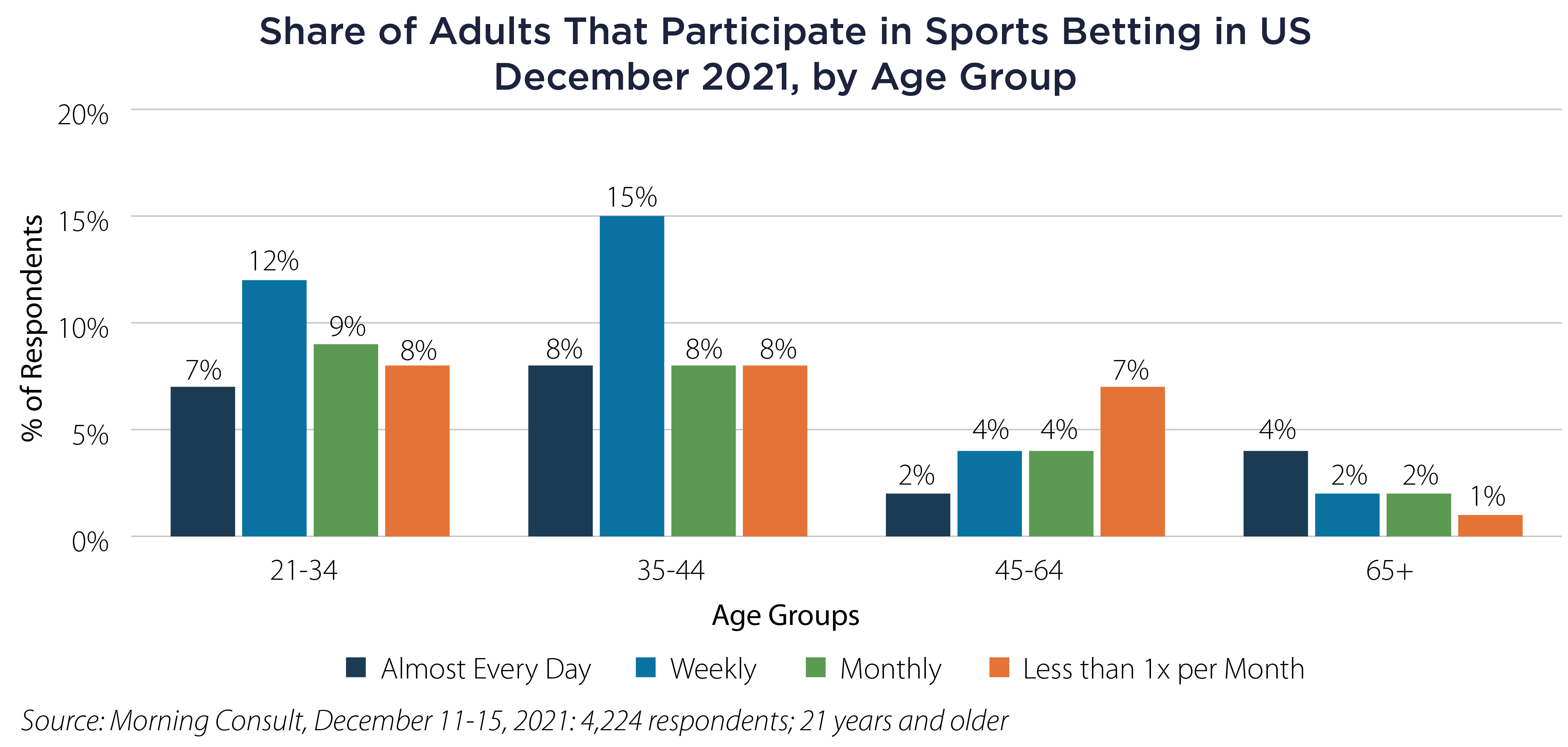

Third, the story behind the sustainable growth is rooted in the demographics of sports betting. Younger people are adopting it very quickly and, surprise, it becomes habitual. Roughly 30% of adults under the age of 45 participate in sports betting at least monthly. It’s interesting to compare this to the number of adults of similar age that meet the CDC’s minimum physical activity targets (28%). Maybe not surprising.

Third, the story behind the sustainable growth is rooted in the demographics of sports betting. Younger people are adopting it very quickly and, surprise, it becomes habitual. Roughly 30% of adults under the age of 45 participate in sports betting at least monthly. It’s interesting to compare this to the number of adults of similar age that meet the CDC’s minimum physical activity targets (28%). Maybe not surprising.

For an industry that is only five years old there are undoubtedly plenty of pitfalls and challenges ahead, so investing in the industry has to be considered within the context of immaturity, costly growth and extraordinary competitiveness. The point here is only that the big picture growth story has legs.

For an industry that is only five years old there are undoubtedly plenty of pitfalls and challenges ahead, so investing in the industry has to be considered within the context of immaturity, costly growth and extraordinary competitiveness. The point here is only that the big picture growth story has legs.

Good luck wagering – at least a third of you 😊

Important Disclosures & Definitions

AAI000515 11/14/2024