As of December 2022, the United States boasted approximately 142,000 towers and 450,000 small cell nodes, forming the foundational infrastructure for mobile communications.1 Cell tower companies play a pivotal role by offering the essential physical infrastructure, encompassing land, permits, power and towers, which are vital to their communication carrier customers. These carriers, in turn, install communication radios, switching equipment and connection backhaul at these tower sites to expand their communication services infrastructure. Cell towers will house the assets of two to three carrier customers, allowing for scale and cost-effective access to this highly regulated and limited resource.

Over the past decade, the cell tower industry has undergone consolidation, leaving just three major providers in the market. Given that cell tower penetration is nearing saturation in the US, the revenue growth of cell tower REITs has significantly slowed. The substantial costs associated with carriers switching to new providers, coupled with limited substitution options, have resulted in a relatively stable industry structure for towers, marked by steady margins and minimal customer churn.

Fallen Angels

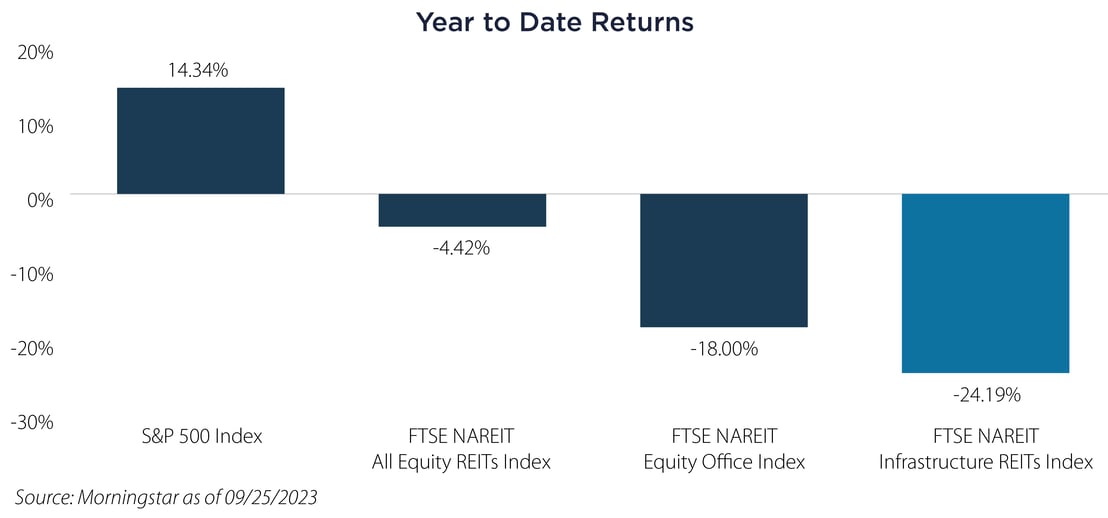

Cell tower REITs have been the worst performing REIT sector so far in 2023, underperforming all REITs, broad equities, as well as the much-maligned REIT office sector.

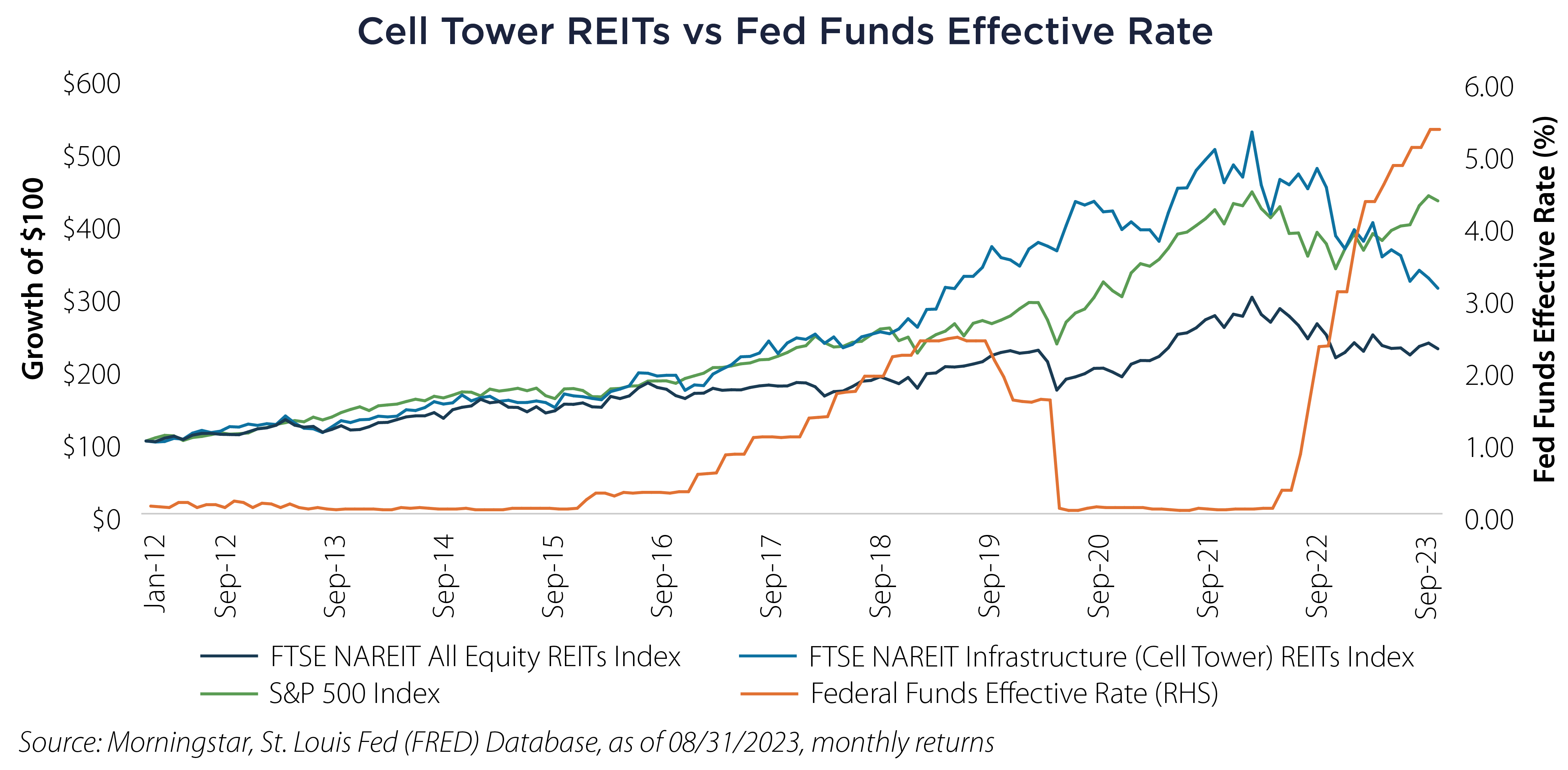

As depicted nearby, until late 2021, cell towers stood as the stars within the REITs asset class, outperforming all other REITs and equities over the previous decade. The proliferation of mobile phones, coupled with the advent of smartphones, created an insatiable demand for bandwidth among end-users (mobile apps like YouTube, TikTok and Instagram consumed massive amounts of mobile bandwidth), along with the need for broader network coverage. Fueled by the expectation of seemingly limitless growth from carrier customers, investors drove cell tower valuations to stratospheric levels. At their peak in June 2020, Net Asset Value premiums exceeded 100%.2

As depicted nearby, until late 2021, cell towers stood as the stars within the REITs asset class, outperforming all other REITs and equities over the previous decade. The proliferation of mobile phones, coupled with the advent of smartphones, created an insatiable demand for bandwidth among end-users (mobile apps like YouTube, TikTok and Instagram consumed massive amounts of mobile bandwidth), along with the need for broader network coverage. Fueled by the expectation of seemingly limitless growth from carrier customers, investors drove cell tower valuations to stratospheric levels. At their peak in June 2020, Net Asset Value premiums exceeded 100%.2

One of the primary catalysts behind the negative returns of cell tower REITs is a decline in demand from major carriers, specifically AT&T, Verizon and T-Mobile, who collectively contribute a significant portion of revenue to major cell tower companies. Factors such as higher interest rates, project costs exceeding expectations, and concerns about customer growth have prompted carriers to scale back their network expansion plans, including the deployment of 5G technology. This scaling back has had a dampening effect on the growth and valuations of cell tower REITs. Furthermore, the coverage provided by cell towers is approaching saturation in the US, which means that expectations of growth patterns seen in the past may now be unrealistic.

Cell Tower REITs Capital Structure

Investor concerns regarding balance sheet debt may have contributed to the recent drawdown. However, upon closer examination of cell tower REITs' capital structure, such concerns may be unfounded. Their capital structure seems robust, characterized by low leverage ratios, a substantial portion of fixed debt, a six-year refinance window and relatively low interest rates.

| Cell Tower REITs Capital Structure |

| Leverage Ratio |

37.2% |

| Debt/EBITDA |

9X |

| % Debt Fixed |

88.8% |

| Weighted Average Time to Maturity |

5.9 years |

| Weighted Average Cost of Debt |

3.5% |

Source: Green Street, as of 08/31/2023

EBITDA: Earnings Before Interest, Taxes, Depreciation and Amortization

The 9X debt/EBITDA ratio could pose a problem, as it is 50% higher than the average debt/EBITDA ratio for listed REIT companies in the United States.3

Outlook

It is evident that a seismic shift is currently underway in the valuations of cell tower Real Estate Investment Trusts (REITs). These valuations are closely linked to the economic performance of the carrier customers they serve, and it's possible that current valuations accurately reflect the economic value of these companies.

While the balance sheets of cell tower companies remain relatively healthy, their communication carrier customers are grappling with the complex economic factors. These include the insatiable demand for mobile bandwidth, the need for the next round of capital expenditures to meet this demand and the reality of a maturing business that has reached full customer penetration in its addressable market.

Furthermore, as the market consensus leans towards a "higher for longer" interest rate environment, the increased cost of capital is likely to encourage carriers to adopt a more cautious approach to network expansion. This caution is expected to temper expectations for growth in cell tower demand.

In the absence of significant growth catalysts on the horizon, cell tower REITs appear to be evolving into a more traditional REIT model. This new model emphasizes a strong income component, stable margins, with some, albeit limited, growth potential.

Important Disclosures & Definitions

1 Wireless Infrastructure Association, as of 12/31/2022

2 Green Street, as of 08/31/2023

3 Green Street, as of 08/31/2023

FTSE NAREIT All Equity REITs Index: a free-float adjusted, market capitalization-weighted index of US equity REITs. Constituents of the index include all tax-qualified REITs with more than 50 percent of total assets in qualifying real estate assets other than mortgages secured by real property.

FTSE NAREIT Equity Office Index: a subsector index of the FTSE NAREIT US Real Estate Index containing all Office REITs in the parent index.

FTSE NAREIT Infrastructure REITs Index: a subsector index of the FTSE NAREIT US Real Estate Index containing all Infrastructure REITs in the parent index.

S&P 500 Index: widely regarded as the best single gauge of large-cap US equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

One may not invest directly in an index.

AAI000422 10/03/2024