• The recent concentration of returns in the US Equity market has left many behind

• We revisit the concepts of Quality Growth and Quality Value in Equities

• There does not appear to be a premium required to own quality companies

So far in 2023, the US equity market has been characterized by the concentration in performance amongst some of the highest quality large cap growth stocks and those that benefit from the emergence of Artificial Intelligence (AI) as the dominant theme.

This phenomenon has been discussed widely, so we won’t belabor the point other than to point out some interesting data. Year to date, the Russell 1000 ETF, which tracks the Russell 1000 Index, is up just under 15% (as of 06/20/2023). The lion’s share of this return has been driven by the largest stocks in the index. The top eight stocks (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms, Berkshire Hathaway and Tesla) have generated an average total return year to date of 80% (!), and currently represent over 26% of the Russell 1000 ETF. By way of comparison, the remaining 990 or so companies in the index have generated an average return of 9%, and a median return of 5% (Source: Credit Suisse HOLT).

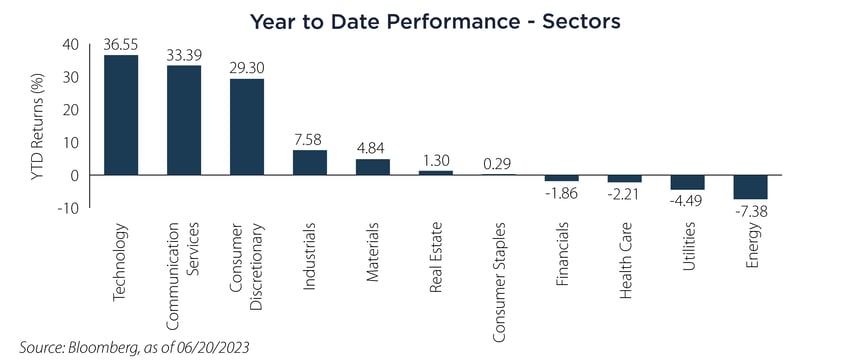

This concentration of performance has also manifested itself in the performance of a few sectors of the market. The nearby chart shows the year to date (YTD) performance of the State Street Select Sector SPDR ETFs, which track the 11 sectors of the S&P 500 Index.

Four of the sectors are down for the year, with Technology, Communication Services and Consumer Discretionary clearly driving the market. Of those largest eight stocks above, only one (Berkshire Hathaway) does not reside in these sectors.

The point here is that a very large part of the market has been left behind during the recent rally. Which led us to ask where we might find opportunities outside of the recent concentration.

In June, we discussed the attractiveness of building core allocation portfolios by starting with an allocation to both Value and Growth, but with a quality overlay. In other words, using quality to filter out companies with below average profitability characteristics.

Given the concentrated performance so far this year, with most of the market being left behind, investors are not currently required to pay a premium for quality. Our friends at Credit Suisse HOLT have developed a comprehensive approach to assessing quality, using return on invested capital (ROIC) level and volatility to rank companies relative to peers. Currently, high quality companies (those ranking in the top 20% of HOLT’s quality score) are currently trading, on average, at a price-to earnings ratio of 21x, which is equal to the average of 21x in the Russell 1000 ETF. So we are not required to “pay up” for quality at this time (Source: Credit Suisse HOLT).

Portfolio Implications

We have shown that using a quality overlay in a core portfolio allocation can generate attractive risk adjusted returns to investors. In today’s market, the further good news is that we can access that quality without paying a premium.

Important Disclosures & Definitions

Russell 1000 Index: an index of the largest 1000 US companies by market capitalization.

S&P 500 Index: widely regarded as the best single gauge of large-cap US equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

One may not invest directly in an index.

Performance data quoted represents past performance. Past performance is no guarantee of future results; current performance may be higher or lower than performance quoted.

AAI000583 06/27/2024