• With approximately $500 billion of commercial real estate debt per year maturing over the next five years, real estate investors face significant challenges to refinance debt and restructure their balance sheets for a higher rate environment.

• Contrary to the ominous debt headlines, public REIT balance sheets appear to be in relatively good shape with a 6.0 year average debt maturity, 86% of which is fixed rate, with a 33.5% leverage ratio.

• Private real estate investors – pension funds, foundations, sovereign funds and insurance companies – will likely bear the brunt of the debt refinancing challenges in the coming years.

Commercial Real Estate and Debt

Debt, especially cheap and abundant debt, could be called the lifeblood of real estate investing. Properties can be financed at 80% or more of their value, debt payments are typically fixed over the 7-10 year life of the loan, the interest on debt is tax deductible and both the property’s income stream and value will likely increase over time due to economic and inflation factors.

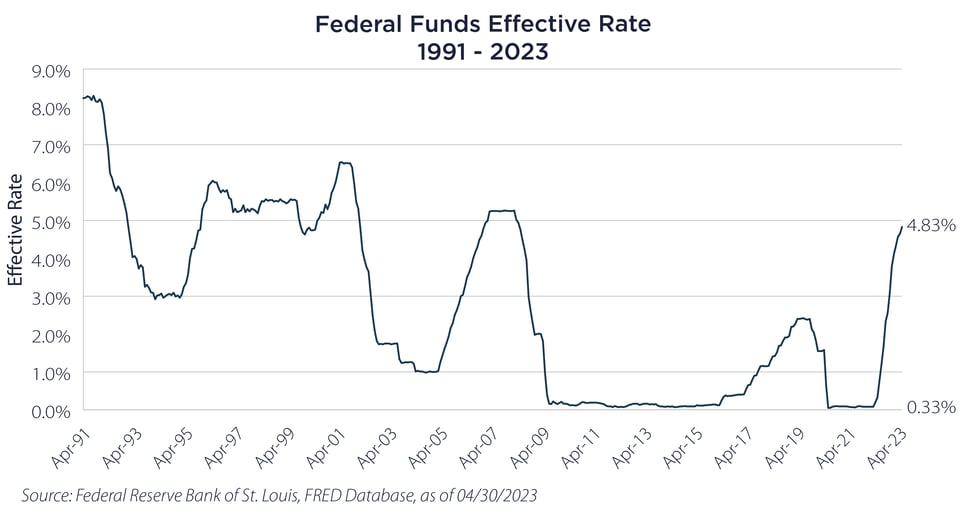

The low interest rate environment since 2009 only increased the appetite for debt financing and higher leverage ratios, driving investors to pursue deals that may have been less economically compelling under a more normalized interest rate regime. As the “transitory” inflation of 2021 became “persistent” into 2022, it provoked the Federal Reserve to rapidly raise rates and sent the Federal Funds Effective Rate from 0.33% in April 2022 to 4.83% in April 2023, one of the fastest increases in modern history.

Given the fundamental role that debt has in real estate capital structures, this dramatic increase effectuated significant turmoil as managers and investors assessed the impact on margins, balance sheets and the cost of capital. One outcome from this process was a concern over the ability for real estate managers to refinance debt. And perhaps the central narrative that emerged was that, after more than a decade of easy money, the time was fast approaching when investors would need to “pay the piper.”

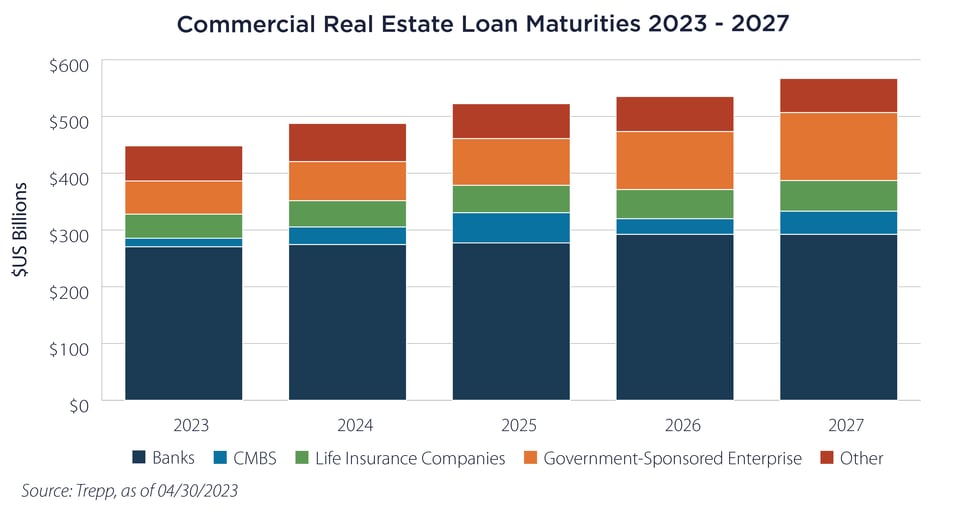

Below is a chart illustrating a somewhat ominous picture for commercial real estate debt – namely that every year for the next five years, around $500 billion of debt will need to be refinanced and at significantly higher prevailing rates. Note that several sectors, such as office and retail, face additional headwinds from significant changes in demand - work-from-home and ecommerce growth - that will only compound their debt refinancing challenges.

Public REITs Balance Sheets Appear to be in Historically Good Shape

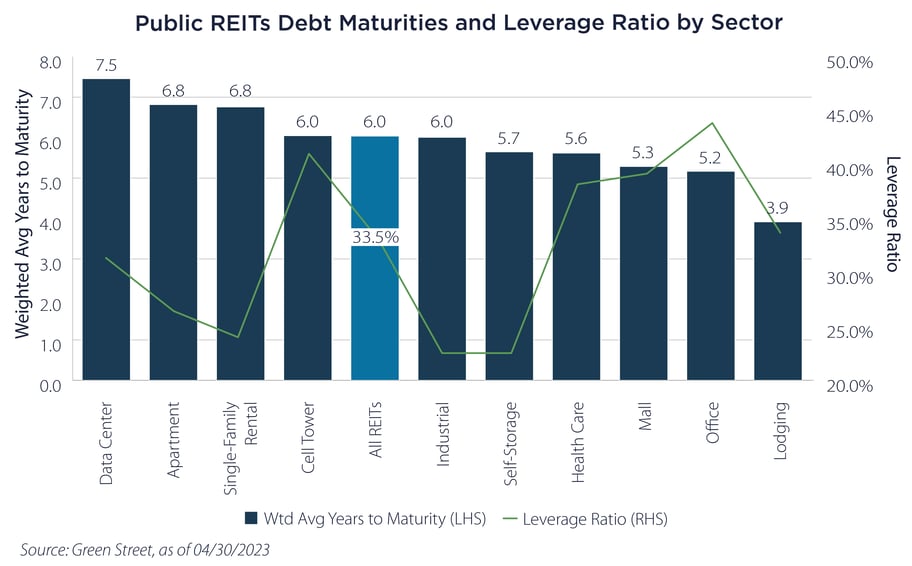

Digging through this narrative and its related data, there is some good news regarding REITs and their current debt situation – namely that REIT balance sheets are in historically good shape. As illustrated in the nearby chart, the average maturity for REITs is 6.0 years which indicates that refinancing efforts would be deferred until late this decade, potentially in an environment of stable, if not lower prevailing interest rates.

With an average or 86% fixed debt and leverage ratio of 33.5%, REIT balance sheets are significantly better positioned than the period prior to the financial crisis, when ratios were greater than 50%.1 This cushion of low leverage provides additional refinancing flexibility by minimizing additional equity infusions for debt refinancing. Debt coverage ratios are also at historically healthy levels.

Private Real Estate’s Debt Problem

So if REITs are in relatively good shape, what is the source of this massive wave of debt refinancing?

It appears that private real estate investors – institutional investors such pension funds, foundations, sovereign funds and insurance companies – will bear the brunt of this turmoil.

Undoubtedly, we are very early in a process that will take years to fully play out. For asset allocators, REITs, with their strong balance sheets and attractive valuations, may be better positioned to provide the attractive long-term risk-adjusted returns and income that real estate has historically provided.

Important Disclosures & Definitions

1 Source: Green Street Data and Analytics.

Federal Funds Effective Rate: the interest rate that depository institutions—banks, savings and loans and credit unions—charge each other for overnight loans.

Leverage Ratio: equal to the total debt of a REIT entity divided by the market value of total assets.

Performance data quoted represents past performance. Past performance is no guarantee of future results; current performance may be higher or lower than performance quoted.

One may not invest directly in an index.

AAI000272 05/23/2024