• Investors should focus on profitable companies that can invest at attractive rates of return

• Although large cap companies tend to be higher quality than small caps, their current valuations largely reflect that differential

• Opportunities may exist in more attractively valued quality small caps

At SS&C ALPS Advisors, we believe that equity investors should focus on the first principle of wealth creation: invest in companies that, over time, can compound wealth profitably.

The stocks that dominate the headlines recently have been mega cap technology companies, often called the Magnificent Seven (Microsoft, Apple, NVIDIA, Amazon, Alphabet, Meta Platforms and Tesla). These companies generally exhibit those qualities we would expect to see from market leaders – high returns on capital and attractive growth opportunities. The valuations of the Magnificent Seven however, may already reflect much of that optimism, with the median P/E ratio of this group in the mid-30s.

Given the higher relative valuations of large caps, we believe investors may find value among smaller companies, as their recent returns have not kept pace with large caps. In the ten year period ending 12/31/2023, large caps, as measured by the Bloomberg US Large Cap Index (B500), have generated a 12% annualized return compared to a 7.8% annualized return for small caps, as measured by the Bloomberg 2000 Index (B2000).

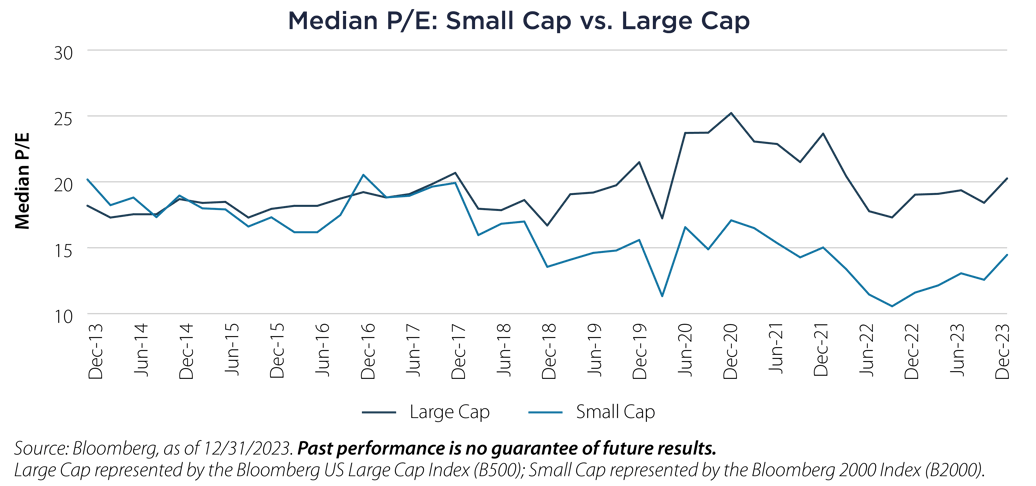

Small cap investing is not without risk, as roughly 30-40% of the companies in the small cap universe lose money. But if we focus on those companies that are in fact profitable we see an interesting trend in valuations. The chart nearby tracks the median forward price/earnings multiple for profitable companies in the B500 vs. the B2000:

The two series started to diverge in 2017, and currently the median multiple for profitable small caps stands at under 15x, compared to the median large cap at about 20x earnings.

While we would continue to emphasize the importance of exposure to quality in portfolios, we believe investors could benefit from the opportunity in higher quality small caps.

Important Disclosures & Definitions

Bloomberg US Large Cap Index: a float market-cap-weighted benchmark of the 500 most highly capitalized US companies.

Bloomberg 2000 Index: measures the performance of the small-cap segment of the US equity universe.

Price/Earnings (P/E) Ratio: a valuation ratio of a company's current share price compared to its per-share earnings.

One may not invest directly in an index.

AAI000646 03/19/2025