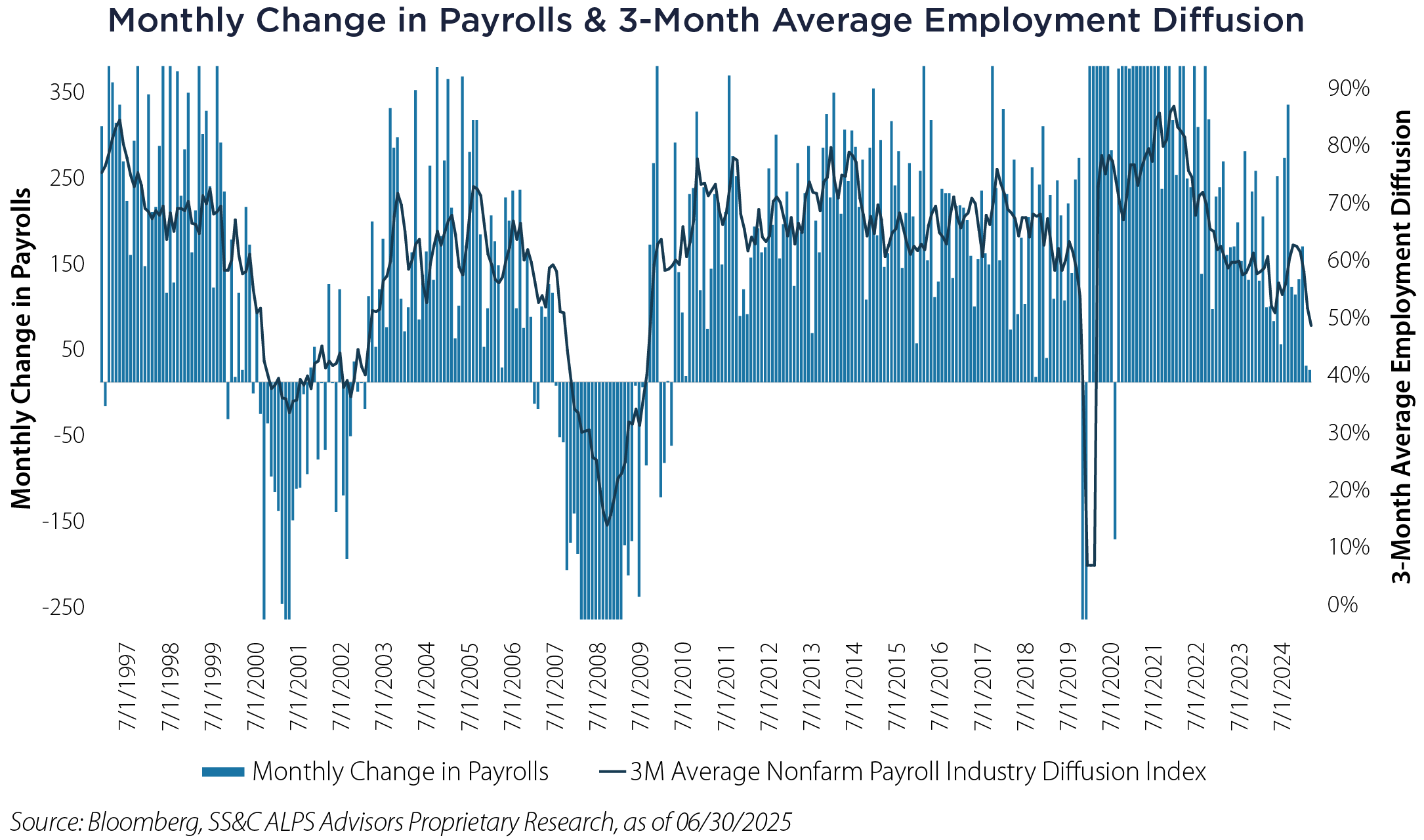

The labor market is sending a signal that deserves closer attention from financial advisors navigating today's economic landscape. While the unemployment rate remains stable due to falling labor force participation and reduced labor supply, a deeper examination reveals more troubling undercurrents.

One telling development lies beneath the surface of the overall payrolls data which itself is slowing. When we strip out government and health care jobs—sectors that tend to operate independently of typical business cycles—the remaining "procyclical" employment has declined for two consecutive months on a three-month average basis. This puts the latest three-month average jobs added for the procyclical segment in the 17th percentile of monthly figures over the last 30 years. Residential construction, a segment of the labor market whose losses are often cited as an early warning for recessions, has shed jobs four months in a row based on the latest revised data.

This shift is supported by the changing growth environment that we’ve been discussing for over a year. While recent GDP growth has been all over the place due to volatility in international trade and inventories, real domestic final demand has decelerated linearly from 3.7% to 1.1% over the last four quarters. Because economic growth tends to lead jobs, we view the current labor market as particularly vulnerable.

This shift is supported by the changing growth environment that we’ve been discussing for over a year. While recent GDP growth has been all over the place due to volatility in international trade and inventories, real domestic final demand has decelerated linearly from 3.7% to 1.1% over the last four quarters. Because economic growth tends to lead jobs, we view the current labor market as particularly vulnerable.

Equally concerning is the employment diffusion index, which tracks the percentage of industries that are actively adding workers. This metric has fallen well below 50%, meaning that more industries are now shedding jobs than adding them on a three-month average basis.

These employment patterns align with what we might expect given the Federal Reserve's sustained higher interest rate campaign. The elevated federal funds rate reflects the central bank's efforts to cool down an overheated economy, and the labor market appears to be responding as intended.

The convergence of these indicators suggests that the economy may be more vulnerable to a self-reinforcing slowdown than the headline unemployment numbers initially suggest. When fewer industries are hiring and cyclical employment begins contracting, the stage is set for the kind of broad-based consumer weakness that can proliferate rapidly in the face of an economic shock.

For investors, this environment underscores the importance of no longer only seeking returns from an ever-resilient US economy but rather maintaining allocations in diversifiers that allow portfolios to weather potential US economic turbulence.

Important Disclosures & Definitions

Nonfarm Payroll: measures the number of workers in the US economy, excluding farm employees, self-employed individuals, volunteers, private household workers, sole proprietors and active military service members. Data collected by the Bureau of Labor Statistics.

Nonfarm Payroll Industry Diffusion Index: the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment. One may not invest directly in an index.

Federal Funds Rate: the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which the Fed suggests commercial banks borrow and lend their excess reserves to each other overnight.

AAI000977 08/12/2026