Summary

Equity investing is an important component of an investor’s portfolio. Stocks build savings, protect against inflation and can maximize returns from investments. However, forecasting can be very complex and challenging, with different frameworks often leading to completely opposing views. For the purposes of building equity model portfolios for our clients, we focus our attention on the most important factors that drive long-term returns and utilize straightforward frameworks to make our forecasts.

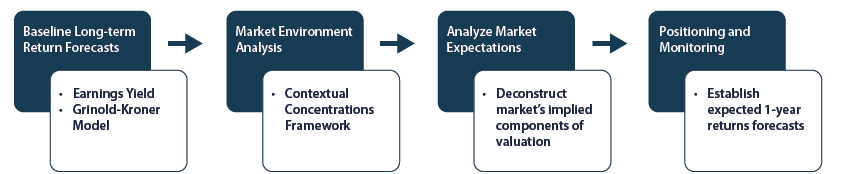

Our forecasting framework begins by establishing long-term expected returns using earnings yield as a baseline. We then utilize our Contextual Concentrations Framework to identify the market context and create medium-term forecasts. The foundation of our system relies upon the following formulas which we will expand upon throughout this paper:

| Forecast |

Formula |

| Long-term |

Expected Returns = Earnings Yield |

| ↓ |

Total Returns = Dividend Yield + Earnings Growth + Change in Valuation |

| Short-term |

Asset Value = Earnings * (1 − (Growth / ROIIC)) / (CoC − Growth) |

We begin with the first equation. Similar to bonds, starting yield is a good estimation of future returns over long time frames as long as cash flows revert to a long-term mean. As such, we believe earnings yield (earnings/price) to be a simple and effective starting point for forecasting long-term returns.

Next, the second equation displays the three primary components of total returns. Dividends and earnings growth are generally stable, observable factors that are core to return expectations, and thus claim the bulk of our attention for strategic, long-term forecasts. The change in valuation is mean reverting, and we consider this contribution to expected returns alongside the prevailing market environment.

While earnings yield is a good indicator for the long-run, in medium-term time frames returns become more influenced by the market context. We determine our medium-term forecasts by dissecting the components of asset valuation and considering the macroeconomic environment’s influence on each component.

The construction of an equity forecasting framework is for the purpose of building durable portfolios, and so we must approach the effort with this in mind.

| Framework Process |

Results Summary |

Implications |

| I. Baseline Long-term Return Forecasts |

Establish baseline return expectations by merging earnings yield with Grinold-Kroner Model returns. |

Earnings Yield, Dividend Yield, Earnings Growth, Valuation |

| II. Market Environment Analysis |

Utilize Contextual Concentrations Framework to analyze current market environment. |

Price, Money Flow, Sentiment, Fundamental |

| III. Market Expectations |

Disaggregate market’s implied valuation components and consider tactical positioning where at odds with market environment analysis. |

Growth, Return on Capital, Cost of Capital |

| IV. Positioning and Monitoring |

Establish expected 1-year return expectations by offsetting baseline forecasts with discrepancies in market analysis and market expectations. |

Performance |

Focus on the Most Important Parts: A Framework for Total Returns

The Grinold-Kroner Model

Total Returns = Dividend Yield + Earnings Growth + Change in Valuation

Beginning with first principles, the equation above (the Grinold-Kroner Model) explains stock returns at the most fundamental level. For any given year, any of these three components can be the primary driver of total returns, however over the long-term this is less likely to be the case. The reason for this is that dividends and earnings growth are more persistent, while change in valuation is mean reverting. This means that over a long enough time horizon, the change in valuation will revert towards zero, while dividends and earnings will continue to grow in significance to total returns.

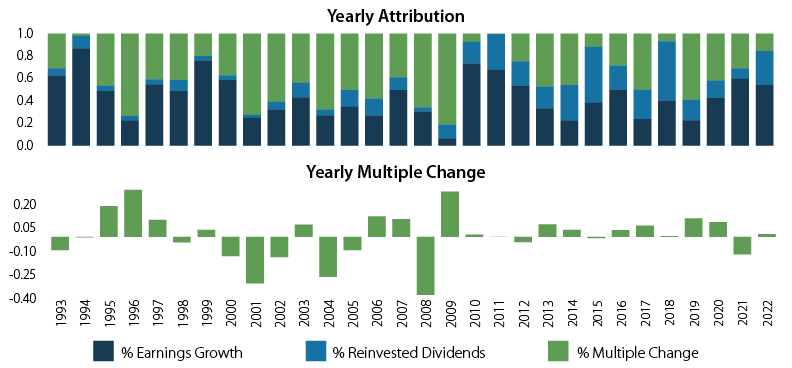

We can observe this relationship in the following charts. The top chart disaggregates the yearly returns of a stock by the percent influence of each of these factors each year over the last 30 year span. In the chart below, we see the directional changes of valuation on each given year – seemingly arbitrarily moving up and down each year.

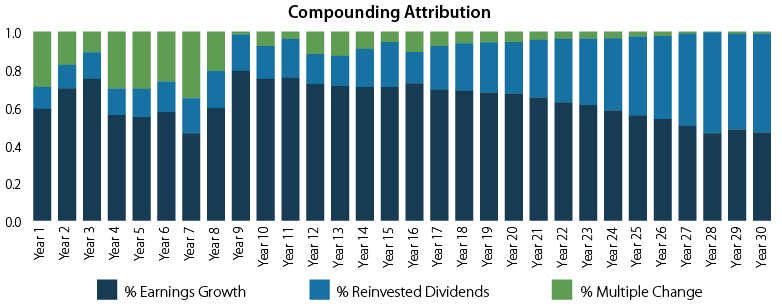

On any particular year we see that valuation change can have an outsized influence on that year’s returns, but because of its fluctuating nature these changes impact returns less and less over the long run. The chart below demonstrates this progression, depicting the continuously compounded attribution of the same stock’s returns over the same time period. The change in valuation’s influence reverts towards zero over time, and reinvested dividends and earnings growth dominate total returns.

On any particular year we see that valuation change can have an outsized influence on that year’s returns, but because of its fluctuating nature these changes impact returns less and less over the long run. The chart below demonstrates this progression, depicting the continuously compounded attribution of the same stock’s returns over the same time period. The change in valuation’s influence reverts towards zero over time, and reinvested dividends and earnings growth dominate total returns.

Our long-term forecasting framework emphasizes the long-term drivers of investing returns by focusing on earnings growth and dividends and considers the forces that may cause valuation to rotate around its long-term mean. In this respect, valuation can either be a headwind or a tailwind depending on its relationship to the mean.

Our long-term forecasting framework emphasizes the long-term drivers of investing returns by focusing on earnings growth and dividends and considers the forces that may cause valuation to rotate around its long-term mean. In this respect, valuation can either be a headwind or a tailwind depending on its relationship to the mean.

As mentioned previously, dividends and earnings tend to be more stable factors than valuation. We formulate the dividend component of our forecast with the consensus for next period’s indicated dividend yield. For earnings growth we use historic through cycle growth to set a baseline forecast.

Because valuation discrepancies can persist longer than expected and reversions manifest suddenly, we developed a framework to decipher different market environments. Over the medium-term, valuation forecasts are implemented by understanding the macroeconomic context, fundamental momentum and their influence on the primary components of valuation. We then form tactical return expectations for opportunities and risks over the medium-term.

Identifying the Market Context: The Contextual Concentrations Framework

We developed the Contextual Concentrations Framework to better understand the potential for emergent factors to drive medium-term equity market returns. We evaluate four distinct components of investment demand and assign a positive, negative or neutral rating to their respective momentum, creating a mosaic of the general market environment. The general principle behind this framework is that each component separately exhibits directional momentum and the number and strength of components exhibiting momentum can be material to the tactical forecasting process. Specifically, macroeconomic and competitive industry dynamics can drive potential changes in fundamental momentum across companies and industries, which is paramount in our assessment of changing earnings growth and cash flow patterns. We discuss our Contextual Concentrations Framework in depth in this research note, and we list the four components in the associated table below:

| Factor |

Description |

| Price |

We evaluate price momentum by reviewing relative and absolute performance alongside broader technical analysis. The interplay between moving-average, relative strength and other momentum indicators provides valuable information. This analysis helps us dissect the aggregate market performance by analyzing the performance and correlations of sectors and subsectors to determine the material return drivers during any particular timeframe. |

| Money Flow |

We monitor the growth and decline of aggregate money supply at the global, national, asset class and sector level. While the market is often described as a zero sum game with a winner for every loser, the reality is more often associated with the expansion and contraction of the money supply. By monitoring this factor we gain a greater understanding of the overall flow of money, as well as the particular market segments most vulnerable. |

| Sentiment |

The absolute level of sentiment is often considered a contra-indicator for future performance, which is why we consider it alongside the directional momentum of sentiment. Is it improving or deteriorating? This directional change from absolute levels can be very informative. |

| Fundamentals |

The absolute and directional change of underlying fundamentals such as profit margins, sales growth and discount rates are significant to understand the context of a market environment. As earnings are a major driver of long-term returns, we must understand the trend of all the components driving profitability. We further extend this into macroeconomic indicators that influence future earnings such as productivity reports and interest rates. |

After cataloging the risks and opportunities to earnings growth and cash flows afforded through our Contextual Concentrations Framework, we evaluate what is priced into the market’s current expectations and adjust our return forecasts for the medium-term based on how our views differ. Generally, market conditions are accommodating and valuation is a tailwind to returns. However, our framework tolerates a nimble approach as the context shifts.

Forecasting within a Context: A Framework for Valuation

Disaggregating the P/E Ratio

The most important parts of valuation are the interplay between Return on Incremental Invested Capital (ROIIC), Cost of Capital and growth. ROIIC is simply the return a company generates on a new investment. If a pizza company spends $100 to build a new oven, and generates $5 from the new oven, the ROIIC is 5%. Cost of Capital should be thought of as opportunity cost – what could the pizza company expect to earn on other opportunities using that $100 – and it is widely based on the US 10-year treasury interest rate, or the risk-free rate. For this example, let’s assume it is 2%. Thus, the profitability of the new oven is $3 (ROIC – Cost of Capital) x Invested Capital. We then factor in the potential growth of this profit to determine a value.

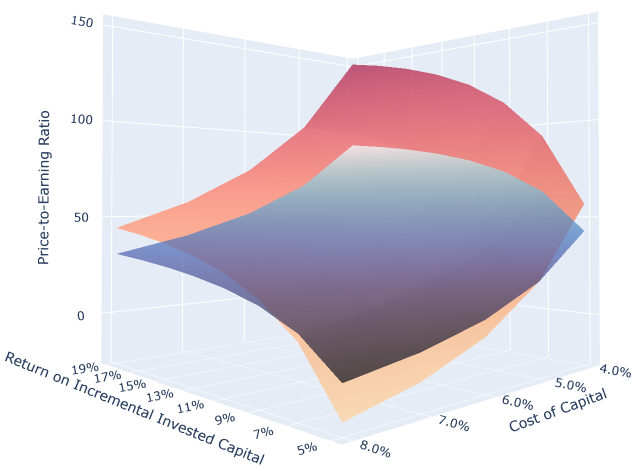

An illustration of how ROIIC and the Cost of Capital affect valuation (Price-to-Earnings) is shown in the above chart. The red and orange plane shows the relationships for a 17% estimated growth rate, which analysts assigned to the Nasdaq 100 Index as of September 2021. The blue plane shows the relationships for a 13% estimated growth rate, which is the expected growth rate for the same index as of January 2023. The key takeaway is that an increase in the Cost of Capital (which is directly tied to interest rates) can dramatically reduce valuations, and the rate of reduction is more dramatic for higher growth expectations. These models are not at all perfect, but they are useful tools in formulating capital markets expectations.

Identify Opportunities and Risks

By deconstructing asset valuation into its primary components we are able to better understand the relationship between each component and value. For forecasting purposes, we can use this model as a prism to assess any given asset and interpret the market’s view of each component and where that view stands at odds with our own understanding through the Contextual Concentrations Framework.

We can start with the market’s current valuation, identify consensus views for growth, derive Cost of Capital and ROIIC and apply our Contextual Concentrations Framework to catalog instances that represent extreme deviations between the market’s view and our own. In such instances, we can enhance or reduce a return expectation appropriately. For shorter time frame forecasts, this framework can be very useful as various assets perform differently depending on the market context.

Bringing it all Together: A 2021 Case Study

We witnessed the power of this forecasting framework entering 2021 as the market clearly began to shift its context. For years, growth companies garnered unsustainably high valuations alongside a low interest rate environment that rewarded future earnings. However, the Contextual Concentrations Framework helped us to understand the shifting macroeconomic dynamics and that valuations were discounting a future that was antithetical to the emerging environment.

The late stage of the business cycle is characterized by rising inflation and a similar response in interest rates. Although momentum factors remained strong, macro indicators stressed end of business cycle dynamics in which the Cost of Capital would begin to converge with Return on Incremental Capital. Understanding that valuations can deviate from their means for extended periods of time and then revert rapidly, we forecasted a higher risk associated with high-multiple growth stocks. We were able to tactically navigate this situation by understanding which equity sectors were most vulnerable to the fluctuating circumstances, and adjust our forecasts accordingly.

We developed our equity forecasting framework to emphasize the simple and predictable, while navigating near-term risks and opportunities with tactical solutions. We consider the market environment and the market implied risks when creating our short-term forecasts. This equity forecasting framework is a powerful tool when building equity model portfolios.

AAI000865